Some importers from Asia to South America have decided to temporarily halt buying spot LNG shipments from Russia as they wait for more clarity on restrictions against banks and companies, according to traders. Across the board, traders say they are being more cautious about buying LNG or using vessels from Russian entities.

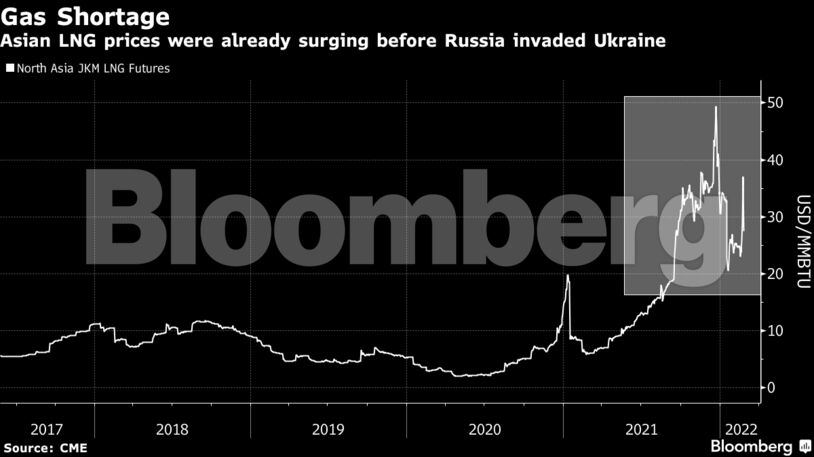

The move will intensify global competition for a shrinking pool of available LNG, exacerbating a global shortage that threatens to send spot prices of the heating and power plant fuel higher. Russia was the fourth-largest LNG exporter in 2021.

Western nations agreed over the weekend to exclude some Russian banks from the SWIFT bank messaging system. Meanwhile, Singapore is planning to announce measures to block certain Russian banks and financial transactions connected to Russia, Foreign Minister Vivian Balakrishnan said in Parliament on Monday.

While the new raft of sanctions don’t directly target energy, the volatile and fast-moving backdrop is making it challenging for LNG buyers to commit to more shipments from Russia.

Some smaller importer are struggling to get letters of credit from banks to purchase Russian LNG, effectively halting their procurement, the traders said, requesting anonymity to discuss private details. At least two of China’s largest state-owned banks are restricting financing for purchases of Russian commodities.

To be sure, LNG importers are continuing to take delivery of Russian shipments under long-term contracts or that were previously purchased, traders said.

- Intra-day value for second-half March DES cargo to North Asia assessed at $40.575, +$6.225 from the previous session, according to S&P Global Platts

- 1H April +$6.175 to $40.375

- There were no bids and offers on S&P Global Platts JKM LNG Market on Close

- Singapore’s Energy Market Authority purchased an LNG cargo on a DES basis for delivery in March via Singapore LNG Corp., which may indicate that it aims to avoid a near-term supply crunch

- PTT is seeking at least one LNG cargo on a DES basis for April delivery to Thailand

- Gail issued a swap tender seeking to buy an LNG cargo for April 4-10 delivery to Dabhol in India on a DES basis, and offering a cargo loading March 1-8, 2023 from Sabine Pass, U.S., on an FOB basis

| Futures Prices: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS