Jan 21, 2022

(Bloomberg)

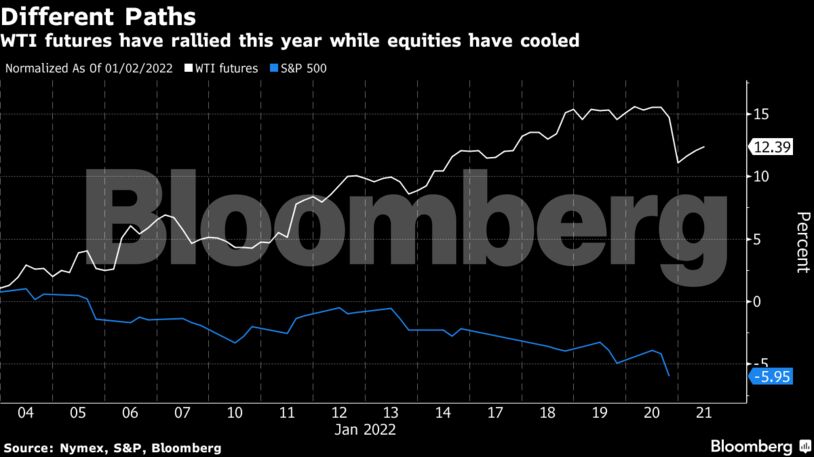

Oil dropped alongside other financial assets and commodities as crude’s sizzling rally to a seven-year high ran out of steam.

Futures in New York slumped more than 3%, before paring losses to trade near $85 a barrel, as stock markets and raw materials including copper declined.

Crude has gained more than 10% so far this year, despite weakness in equities as monetary policy tightens.

Though crude was pressured on Friday, much of Wall Street has been growing steadily more bullish. Morgan Stanley has joined Goldman Sachs Group Inc. in forecasting $100 oil later this year, but Citigroup Inc. cautioned that sticking to a bullish view could be dangerous after this quarter. The International Energy Agency this week said the oil market was looking tighter than previously thought, with demand proving resilient despite the rapid spread of omicron.

“Today the market is experiencing a small setback with the rest of commodity markets, but it is likely not more than consolidation after the recent rally,” said Jens Pedersen, a senior analyst at Danske Bank A/S.

| Prices |

|---|

|

Crude’s bumper rally had pushed many of the main futures contracts into overbought territory on a technical basis. Brent, WTI and heating-oil futures all moved out of that zone amid the sharp price pullback early Friday.

Still, the focus remains on how much further the Organization of Petroleum Exporting Countries and its allies can lift output. Pavel Zavalny, head of the Russian Duma Energy Committee, said restoring production won’t be easy amid technical challenges and underinvestment.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS