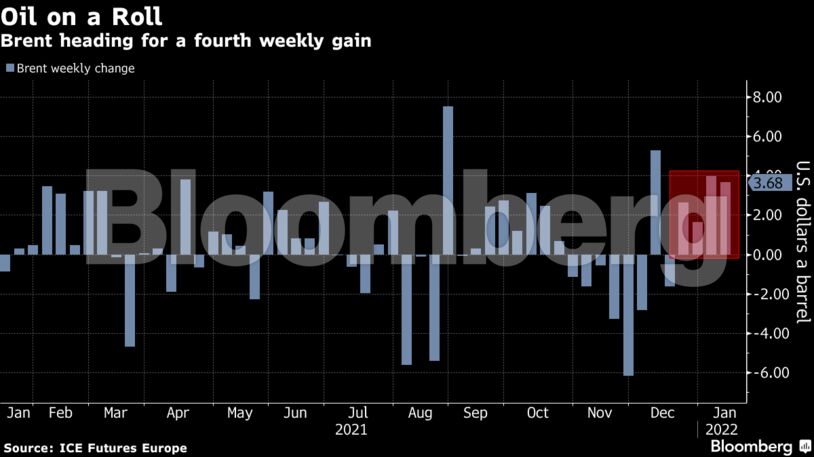

Crude has now clawed back most of its losses late last year that were driven by omicron and the White House-led releases from national oil reserves. Although it has proved to be fast-spreading, the variant also appears to be milder, particularly in vaccinated people, lessening the impact on energy consumption. Major user India is poised to weather the latest scare. The International Energy Agency said earlier this week that global oil demand has turned out to be stronger than expected.

Oil prices are finding support from physical markets — where real barrels are bought and sold — as supplies change hands at healthy premiums. There’s also global strength in the diesel sector. With prices climbing higher, traders are watching whether the Organization of Petroleum Exporting Countries and its allies will be able to deliver their planned monthly production increases in output in full.

“The price slide that was triggered by the emergence of the omicron variant has been reversed completely,” said Carsten Fritsch, an analyst at Commerzbank AG. “Omicron’s impact on oil demand has been considerably milder so far than initially feared.”

| Prices |

|---|

|

Optimism about the demand outlook is reflected in the market’s bullish backwardated pricing structure, with near-term futures above those further out. The spread between West Texas Intermediate’s two nearest contracts is now well above $6 a barrel, up from less than $3 in early December.

Despite the broadly positive mood, there are notes of caution. China has maintained its strict approach to the virus, while India and some other Asian countries have introduced partial curbs which has caused a drop in mobility. On Monday, China is likely to confirm its weakest economic growth in more than a year, after reporting a drop in annual crude imports on Friday.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS