OPEC+ on Tuesday stuck to its plan to add 400,000 barrels a day next month after it cut estimates for a surplus in the first quarter. However, recent history shows the group has been severely limited in how much it can boost output — adding just 90,000 barrels a day in December, according to a Bloomberg survey.

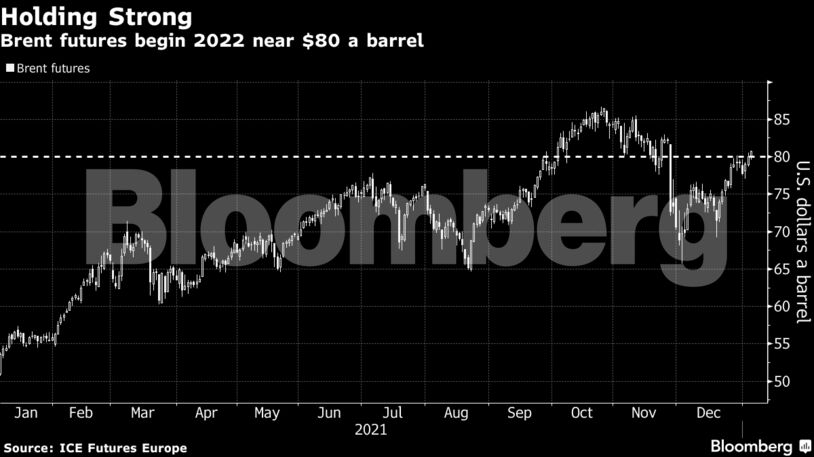

Oil ended 2021 on a strong footing as a string of global supply outages boosted sentiment. Consultant Facts Global Energy said the disruptions — which in recent weeks has included Ecuador, Libya and Nigeria — totaled close to 1 million barrels a day.

Though concerns about the hit to demand from the omicron virus variant have eased and major economies continue to rebound from the pandemic, there’s still some uncertainty in Asia. Hong Kong announced tighter curbs on Wednesday. Earlier this week, the small Chinese city of Yuzhou went into lockdown after a few virus cases, while Xi’an has seen prolonged restrictions after a flare-up.

“The market is clearly concentrating on the price supportive news,” said Barbara Lambrecht, an energy analyst at Commerzbank AG. “Whether the optimism will suffice to ignore the looming supply surplus in any lasting fashion will presumably depend chiefly on the omicron wave.”

| Prices: |

|---|

|

The actual volume that OPEC+ adds to the market in February could be less than planned, due to some members struggling to hit production targets. Energy Aspects Ltd. co-founder Amrita Sen predicts the alliance will increase output by 250,000 barrels a day next month.

See also: OPEC+ Maintains Output Hike as Market Outlook Tightens: Chart

Meanwhile, there has been unrest in Kazakhstan, a member of the alliance. The nation’s president accepted the government’s resignation on Wednesday after increases in fuel prices led to clashes between protesters and the police.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS