Oil prices surged more than 50% last year amid a global economic recovery from the COVID-19 pandemic and as OPEC+ cut supplies, despite a continued surge in COVID-19 cases.

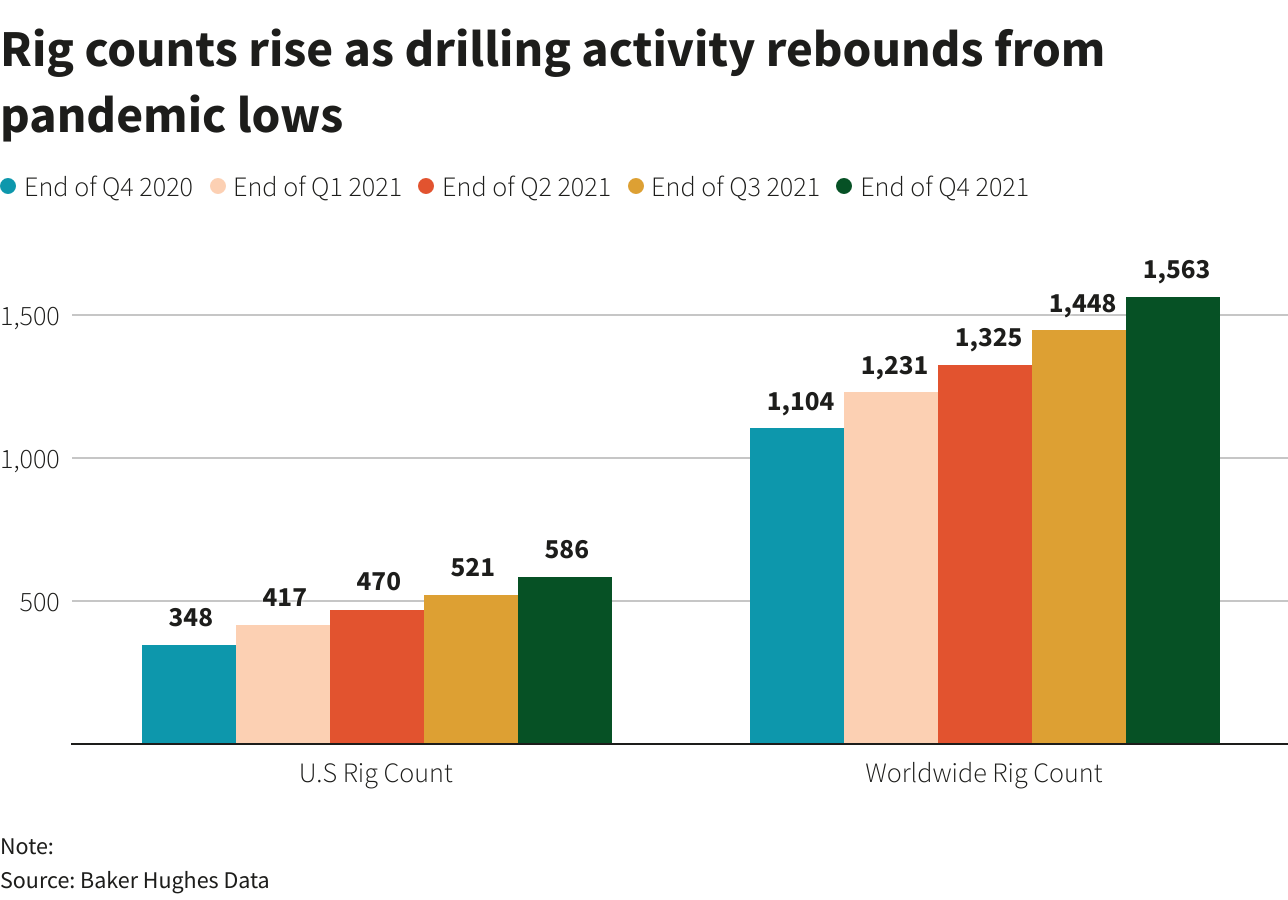

Higher crude prices have encouraged U.S. producers to ramp up drilling activity, with the U.S. rig count rising to 586 at the end of the fourth quarter, compared with 348 at the close of the December quarter in 2020, according to Baker Hughes data.

U.S. crude futures are trading around $86.6 a barrel , while Brent futures are around $88.12 a barrel . U.S. crude futures were roughly flat Thursday morning.

“We believe the broader macro recovery should translate into rising energy demand for 2022 and relatively tight supplies for oil and natural gas,” said Lorenzo Simonelli, the chief executive officer of Baker Hughes, in a release. However, he warned that the pace of economic growth would moderate slightly in 2022 compared with last year.

Shares of Baker Hughes were up 1.52% in pre-market trading to $26.69.

Adjusted net income for the fourth quarter was $224 million, or 25 cents per share, missing analysts’ estimates by 3 cents, according to data from Refinitiv IBES. The same quarter last year, Baker reported a loss of $50 million, or 7 cents per share, last year.

Revenue for the quarter was $5.52 billion, which topped Wall Street forecasts of $5.49 billion.

For the full year, the company reported a loss of $219 million, versus a loss of $9.94 billion in 2020.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet