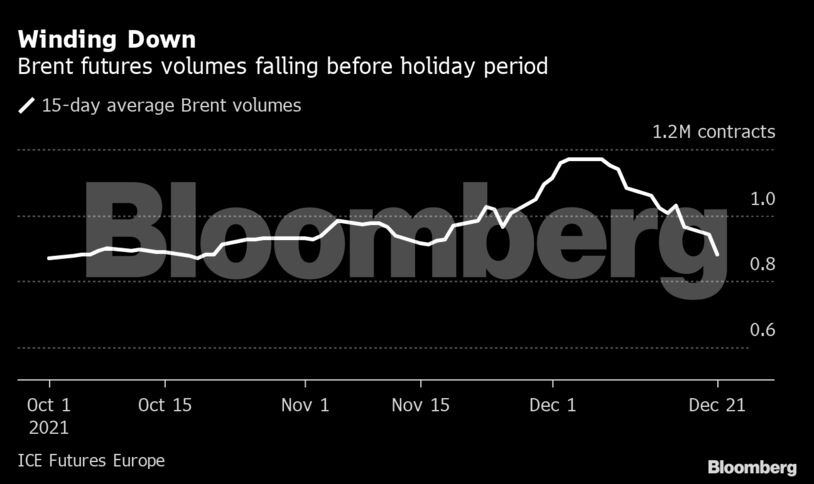

Trading is starting to wane into the Christmas period. Average Brent crude futures volumes over the last 15 days are the least in two months, while WTI open interest has plunged to its lowest since 2016.

“Data remains supportive, with supply outages, elevated flight activity and congestion on roads resulting in still falling inventories,” said Giovanni Staunovo, commodity analyst at UBS Group AG. “Concern on new mobility restrictions impacting oil demand as a result of the Omicron variant is keeping prices in check, however.”

Oil is poised to cap a yearly gain following a rebound from the pandemic, but the rally has faltered over the past couple of months in part due to demand concerns after the emergence of omicron. There are some signs of softening consumption in Asia and crude market’s structure has weakened significantly, indicating over-supply in the near term.

Europe’s energy crunch, meanwhile, has raised the prospect of greater demand for oil products in power generation. Natural gas prices surged after Russia curbed flows, forcing France to boost electricity imports and burn oil to keep the lights on. U.S. Gulf Coast refiners have also trimmed diesel shipments to Europe to prioritize domestic demand and buyers in Latin America.

| Prices |

|---|

|

The American Petroleum Institute reported U.S. crude stockpiles declined by 3.67 million barrels last week, according to people familiar with the figures. If confirmed by government data later on Wednesday, it would be a fourth weekly draw. The Energy Information Administration is expected to report nationwide crude stockpiles fell by 2.5 million barrels, according to a Bloomberg survey.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS