Brent crude fell 3.1% to trade near $71 a barrel in London, though the commodity recouped some of the day’s losses after Moderna Inc. said its Covid-19 vaccine vastly increases protection against the new strain.

Pessimism nonetheless prevailed across financial markets, as rising infections from the U.S. to Europe prompt restrictions on air travel and stricter curbs on movement. While there’s no sign yet of fuel demand cratering as it did early last year, the outlook is increasingly fragile.

Economic sentiment took another setback as President Joe Biden’s $2 trillion package of tax-and-spending was derailed by the surprise revolt of Senator Joe Manchin. Goldman Sachs Group Inc. economists cut their U.S. economic growth forecasts.

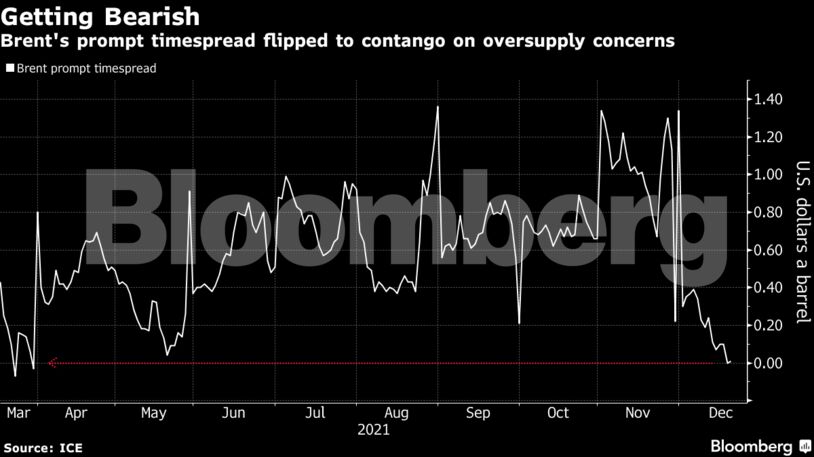

Oil’s market structure is also showing signs of weakness. The prompt timespread for Brent once again flipped into a bearish contango pattern on Monday, indicating the market is becoming oversupplied.

Bearish headwinds are mounting, moving into the holiday period, when thinner trading volumes can exacerbate prices swings. Demand in Asia is softening, central banks are pivoting toward tighter monetary policy to try and rein in accelerating inflation.

“It is not a case of if but when governments impose tougher restrictions,” Stephen Brennock, an analyst at brokerage PVM Oil Associates, said of the impact of the omicron variant. “Brent is now flirting with contango. This is a clear warning for those of a bullish disposition.”

| Prices |

|---|

|

New York state broke a record for new infections and New York City Mayor Bill de Blasio called on the federal government to step up supplies of tests and treatments amid a spike in infections caused by omicron. The Dutch government announced plans to enforce a stricter lockdown, while Germany’s health minister warned of another virus wave caused by omicron.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire