Futures slipped under $72 a barrel in New York, having climbed more than 9% over the prior three sessions. While lab studies by Pfizer Inc. and BioNTech SE show a third dose of their vaccine can neutralize omicron, government restrictions aimed at containing its spread are still casting a shadow over the outlook for consumption.

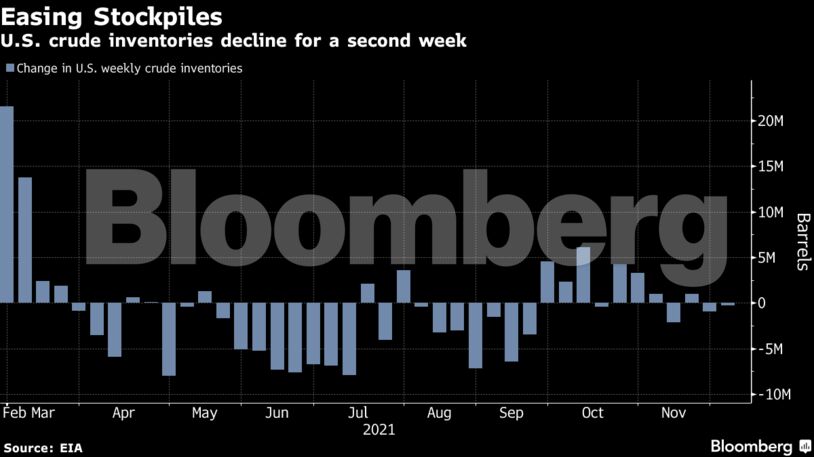

U.S. crude stockpiles, meanwhile, dropped by a modest 241,000 barrels last week for a second weekly draw, according to government data. And in Asia, buyers aren’t seeking extra supplies from Saudi Arabia after the kingdom hiked prices despite weakening physical demand.

Oil has rebounded after falling for six weeks, in part due to major consumers signaling they would release strategic crude reserves to tame energy prices and the emergence of omicron. While demand hasn’t taken a big hit from the new variant, some nations have implemented restrictions on air travel and U.K. Prime Minister Boris Johnson has tightened pandemic rules.

“Yesterday’s news about the effectiveness of a vaccine following a third jab certainly sounded promising,” said Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt. “Nonetheless, Omicron is causing renewed restrictions on public life to be imposed in additional countries.”

Researchers said they observed a 25-fold reduction in neutralizing antibodies to fight omicron with a third dose of the Pfizer/BioNTech vaccine. The findings indicated that two doses “may not be sufficient” to protect against infection.

| Prices |

|---|

|

U.S. gasoline stockpiles expanded by 3.88 million barrels last week, according to the Energy Information Administration. Distillate inventories rose by 2.73 million barrels, while crude supplies at the key storage hub of Cushing climbed for a fourth week above 30 million barrels, the EIA said.

In the physical crude market, Asian refiners won’t be seeking additional supply from Saudi Arabia for next month after the kingdom hiked prices, with signs of weakening in the spot market. Russia’s Sokol crude traded at a three-month low, while some prompt cargoes of ESPO crude have failed to find buyers.

China’s factory inflation, meanwhile, moderated in November from a 26-year high, with the slowdown providing more room for policymakers to support the economy. The easing is a sign that efforts to tame soaring commodity prices and deal with power shortages over the past few months are having an effect.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein