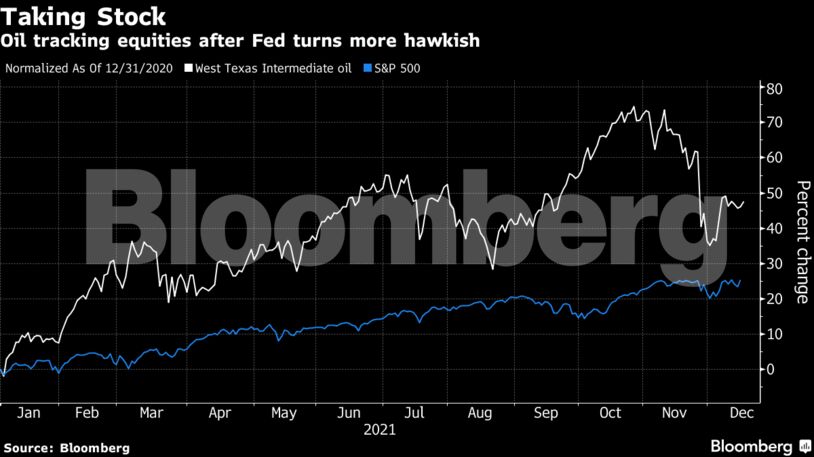

Futures in New York climbed as much as 1.5% after recovering from omicron concern in the previous session to close slightly higher. The S&P 500 settled near an all-time high Wednesday after Fed officials intensified their battle against the hottest inflation in a generation by moving to end their asset-buying program earlier than anticipated.

Conflicting signals on demand and supply have seen oil swing between gains and losses this week. While the outlook for consumption appears to be deteriorating as China, the biggest oil importer, limits holiday travel to try and contain omicron, the picture looks more positive in the U.S. The International Energy Agency said this week that the market was already in surplus, but Vitol Group, the world’s largest independent oil trader, said it expects prices to rise next year due to a lack of new investment in production.

U.S. crude stockpiles declined by 4.58 million barrels last week, the Energy Information Administration reported Wednesday, in a positive sign for consumption in the world’s largest economy. Exports climbed back above 3 million barrels a day with traders pushing barrels out of the country to avoid the impact of year-end taxes on inventories.

“On the one hand we had extremely positive data from the EIA report yesterday, strong implied oil demand, and large inventory draws across crude and oil product,” said Giovanni Staunovo, a commodity analyst at UBS Group AG. “And the other element was the Fed, which has supported all risk assets on Thursday.”

| Prices: |

|---|

|

Surging U.S. gasoline demand before the holiday season suggested concerns about the new virus variant weren’t keeping drivers off the roads. Global onshore crude inventories are also dropping, led by draws in Europe, according to data from consultant Kayrros.

Meanwhile, the physical crude market in Asia softened as a crackdown on China’s private processors and weaker refining margins crimped demand. The spot premium of Russia’s ESPO to the Dubai benchmark slipped to the least since August, while Sokol and Al-Shaheen’s also dropped over the past month.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein