The outlook is deteriorating further on signs that demand in China — the world’s biggest importer of crude — is coming under pressure as the government limits holiday travel to contain the virus, while also cracking down on pollution. Refiners are expected to replenish inventories hesitantly this winter.

“Supply has finally caught up with demand and this trend is forecast to intensify heading into 2022,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates Ltd. “Simply put, the oil market faces a significant oversupply next year.”

Prompt Brent prices have resumed a small premium of 5 cents a barrel after sinking to a discount on Tuesday.

Tuesday’s discount is a warning to bullish investors, and not just because it reflects supply surpassing demand. If the structure returns, it also limits the returns they can get when prompt prices are at a premium, by holding a long position and collecting the yield as they roll from one month to the next.

| Prices: |

|---|

|

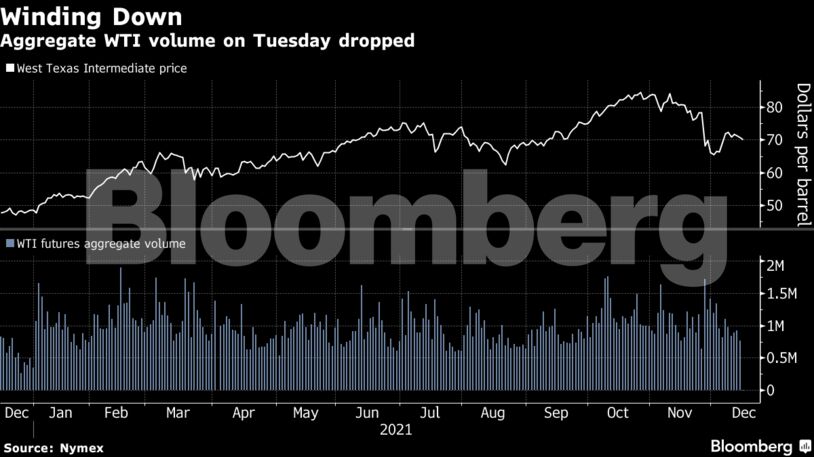

Oil’s drop this week has eaten into a partial recovery from a bear market at the end of November. The fast increase in omicron cases, which have surged to 3% of all those sequenced in the U.S. just this month, coupled with another report showing inflation running hot are likely to dampen risk appetite, which is being reflected in thinning trading volumes ahead of the year-end holiday season. Aggregated trading volumes for the U.S. benchmark on Tuesday shrank to the lowest since Nov. 24.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS