The ambitious — and some say improbable — endeavor is part of Lopez Obrador’s drive to expand homegrown production of gasoline and diesel that Mexico now mostly buys from U.S. refiners. Like many major oil-producing nations, Mexico lacks the processing capacity to convert its oil bounty into fuels and other end-products.

If fulfilled, Pemex’s pledge will mark the exit from international oil markets of one of its most prominent players of the past decades. At its peak in 2004, Pemex exported almost 1.9 million barrels a day to refineries from Japan to India, and participated in OPEC meetings as an observer.

Skeptical Reception

Despite the pledge, questions abound over whether the heavily indebted state driller can achieve its goal and many question the logic of scrapping crude exports that are a significant source of cash for Mexico and Pemex bondholders. The company is shouldering a $113 billion debt load that is larger than that of any other oil explorer in the world.

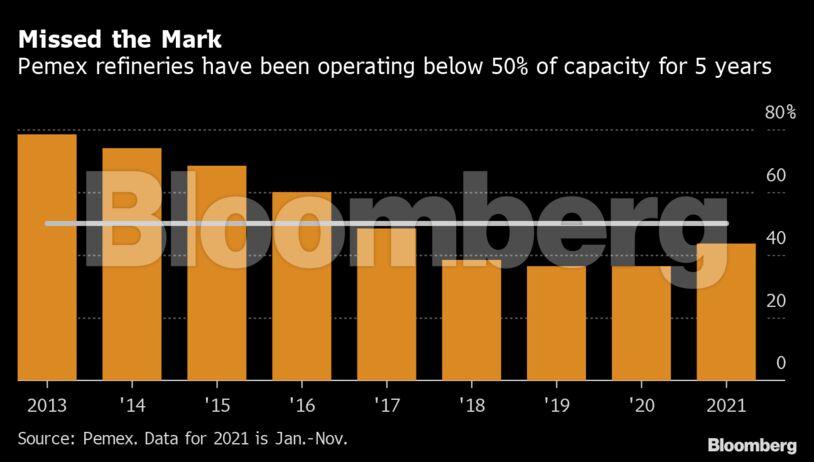

The skepticism about Pemex’s ability to refine all of its own crude output stems from the company’s poor operating and safety record. Pemex refineries have been operating at a fraction of capacity for half a decade after years of underinvestment and lack of maintenance.

In contrast, U.S. refiners typically operate at more than 90% of capacity; even during the worst of the pandemic-driven collapse in energy demand, American fuel makers were churning away at close to 70%.

The pledge “seems impossible to me because the refineries are not capable of operating at 80%,” said Rosanety Barrios, a former energy ministry official under ex-President Enrique Pena Nieto. Another red flag is Pemex’s plan to go it alone without the expertise of foreign partners “so that if something doesn’t go as expected, there is no cushion.”

Production Slump

Last month, Pemex sold slightly more than one million barrels abroad on a daily basis. It’s been struggling to raise so-called runs at its refineries. Meanwhile, its crude output has declined every year since 2004, with the exception of last year due to a rise in production of condensate, a very light oil that’s usually of lower value than regular crude.

To meet its energy goals, Pemex aims to refine 1.51 million barrels of crude a day next year and 2 million in 2023, Romero said. The Mexican driller will plow all of its production into a fleet of refineries that includes the Dos Bocas facility under construction in the southeastern state of Tabasco and a facility being bought near Houston.

Pemex plans to bring Dos Bocas online next year, though full operations are unlikely until 2023 due to cost overruns and construction delays. The refinery in the Houston suburb of Deer Park is categorized by Pemex as part of its national refining system despite its location north of the U.S. border.

Increasing Throughput

Mexico could produce an additional 190,000 to 220,000 barrels of gasoline per day if it succeeds in raising crude processing by 635,000 to 735,000 barrels by 2023. At this rate, Mexico could reduce imports of American gasoline by as much as 50% from 2020 levels, based on data from the U.S. Energy Information Administration.

Asian refineries, which buy more than one-fourth of Mexican crude shipments, are expected to bear the brunt of any export curbs. South Korean and Indian customers would be hit hardest but American and European refiners also would be impacted as Pemex backtracks on previous plans to diversify away from the U.S. market.

Mexico accounted for around 62% of total gasoline exports from the U.S. Gulf Coast in 2020, EIA data show.

“They don’t have the refining capacity in place, they’ve not been able to increase their refining throughput, and the number of accidents has increased tremendously,” said John Padilla, managing director at energy consultancy IPD Latin America. “You aren’t turning off exports unless you significantly reduce production of crude oil, and that would have major consequences for Pemex bondholders. Mexico would need to absorb massive amounts of Pemex debt.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS