Nov 29 (Reuters) – U.S. motorists could see gasoline prices fall below $3.00 a gallon in the coming weeks after crude futures posted their steepest losses since April 2020 on Friday as a new coronavirus variant threatened to extend the pandemic.

A further fall in pump prices from seven-year year highs hit in October would take some of the heat out of U.S. inflation, which rose at its fastest in 31 years in October. The surge, in part due to soaring fuel costs, damaged the popularity of U.S. President Joe Biden.

The global market’s reaction to the newly discovered Omicron variant is likely to affect U.S. gasoline prices more than the coordinated release of crude from major consuming countries’ strategic reserves orchestrated by Biden and announced last week.

The reimposition of air travel restrictions is already hitting fuel demand. The full impact will depend on the extent of mobility restrictions imposed to counter the variant as governments weigh lockdowns to stop its spread. read more

Gasoline prices were expected to decrease anyway in the coming weeks, largely due to lower demand for fuel in the winter months due to colder weather and shorter days, according to Tom Kloza, global head of energy analysis at the Oil Price Information Service (OPIS).

Further price falls may not be good news.

“Be careful what you wish for, because nobody really wants this new virus to weaken economic activity and lower energy demand,” Kloza said.

WHY DID THE OMICRON VARIANT CAUSE OIL PRICES TO FALL?

U.S. crude futures plunged more than $10 a barrel on Friday to $68.15 as fears of a slump in fuel demand due to the reintroduction of broad travel restrictions added to concern that the oil market could see a supply surplus in coming months.

Prices rebounded over $3 when oil markets reopened late Sunday and are expected to be volatile as scientists study the new variant and after traders return from the U.S. Thanksgiving holiday.

If Friday’s losses are consolidated, the corresponding drop in wholesale price of gasoline could push the national gasoline average below $3.00 a gallon, said Patrick DeHaan, head of petroleum analysis at GasBuddy.

“In that case, motorists shouldn’t be in any rush to fill up if the market continues to fall,” said DeHaan.

It may take days or weeks, however, for wholesale prices to be reflected at the pump, because retailers tend to pass on decreases in one to three cent increments for a number of days to lock in margins, DeHaan said.

Unfinished gasoline futures, known as RBOB, tumbled around 30 cents or 12.5% on Friday. Prices could fall further if buyers expect further losses on global markets and delay purchases. Big retailers of gasoline likely have not yet bought gasoline at lower prices, said Kloza.

“If you’re a major store and you think prices are going down, you delay buying,” he said.

HOW DID THE WHITE HOUSE RESPOND TO HIGHER OIL PRICES?

Before the news of the Omicron variant, oil prices had risen quickly as economies recovered from the pandemic and fuel demand rose more quickly than producers could increase supply.

The average retail price of U.S. gasoline last week hovered around $3.40 for a regular gallon, up from roughly $2.11 at this time a year ago. The swift increase – 61% over 12 months – alarmed consumers.

Biden, in his remarks on releasing oil from the strategic reserve, said prices should be about 25 cents lower than they were, referring to the gap between futures – or wholesale prices – and retail prices.

In the last six weeks, that gap widened from roughly 78 cents to about $1.14 a gallon, the highest since April 2020. The five-year average is about 85 cents.

WHAT IS THE DIFFERENCE BETWEEN WHOLESALE FUTURES AND RETAIL GASOLINE PRICES?

Wholesale prices often diverge from retail prices when the former drops sharply, as retailers generally respond to such changes with a lag. In March 2020, the gap widened to $1.64 a gallon as wholesale prices crashed as the coronavirus pandemic worsened while Saudi Arabia and Russia were flooding the market with barrels. It did not return to a more normal spread for two months.

In November 2018 the gap rose to $1.11, and took several months to decline.

WHAT GOES INTO THE PRICE OF GASOLINE?

Crude oil accounts for more than half of the cost, according to the U.S. Energy Department. That price is largely determined by supply and demand worldwide.

Consumers pay additional costs for blending ethanol and other additives, as well as for distribution and marketing. Those costs have risen significantly in recent months, according to Kloza.

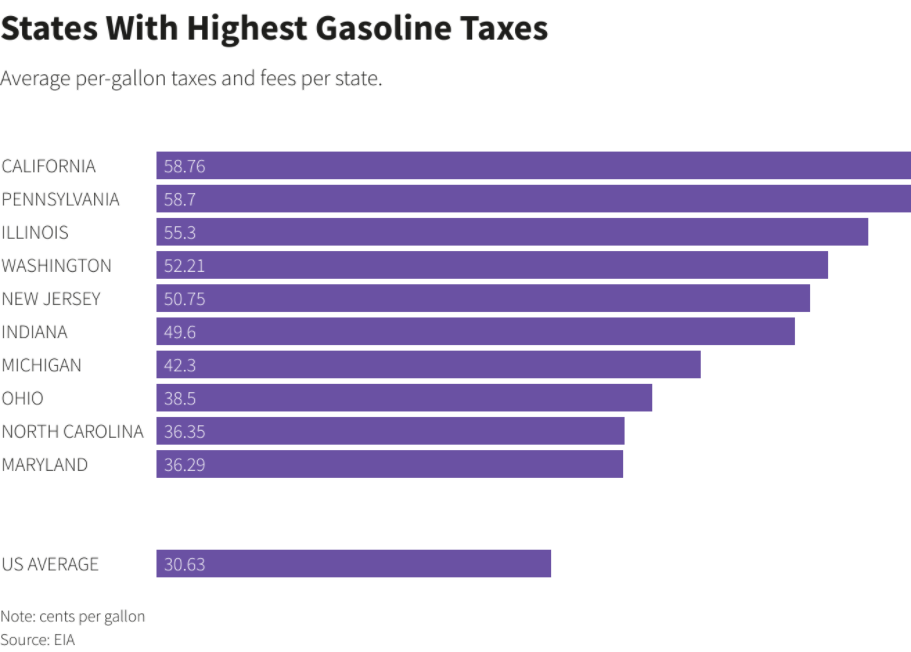

Roughly 17% of the cost comes from taxes. The federal gasoline tax is 18 cents a gallon, while the average taxes and fees per state is 30 cents, although this varies.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet