“OPEC+ staying the course is largely baked in, but the market will watch out for surprises,” said Vandana Hari, founder of energy consultancy Vanda Insights.

Despite the pressure from the U.S. and other importers, the cartel is expected to stick to a plan to raise output by a modest 400,000 barrels a day at its meeting. Azerbaijan on Wednesday joined a roster of OPEC+ nations that have said a modest increase would be enough.

For OPEC+, part of the rationale for the modest tempo of supply hikes is that the pandemic still poses risks, with Saudi Arabia saying last month the crisis is “not necessarily over.” At present, more provinces in China are fighting Covid-19 than at any time since the pathogen first emerged in Wuhan in 2019.

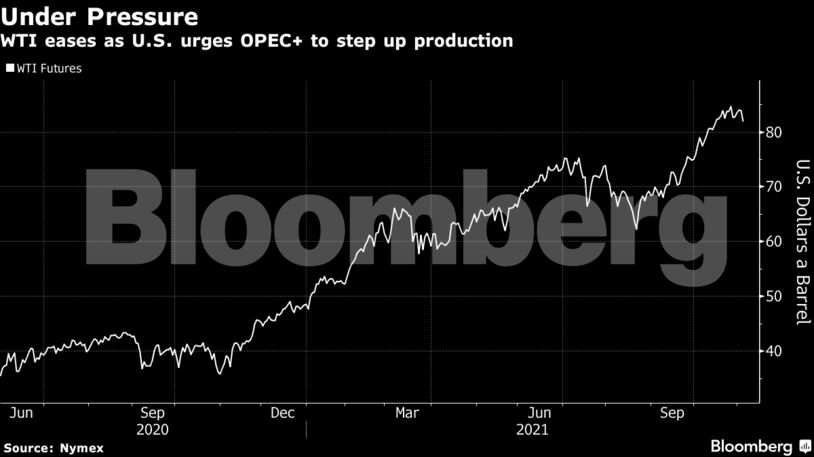

Biden’s comments fanned speculation that if OPEC+ doesn’t accelerate the pace at which it’s adding production, the U.S. — possibly in coordination with other states — may release crude from strategic reserves. National Security Adviser Jake Sullivan declined to say whether that option was being considered.

“It is questionable whether this will cause OPEC+ to soften its stance,” Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt, said of the U.S. pressure. Still, the “debate about the release of strategic oil reserves is weighing on oil prices.”

Prices are also under pressure as the Fed may start tapering stimulus in a first step toward an eventual increase in interest rates. The central bank is expected to announce it will begin winding down the bond-buying program put in place last year to combat fallout from the pandemic. The dollar ticked higher Tuesday, making commodities priced in the currency more expensive for overseas consumers; the U.S. currency was little changed today.

“There’s unease before the FOMC as the taper and future rate hikes may hurt growth,” said Ole Hansen, head of commodities research at Saxo Bank A/S. “Commodities like crude oil have been the go-to markets for investors seeking to hedge against inflation, and if central banks like the Fed turn hawkish, that appetite may fade somewhat.”

| Prices: |

|---|

|

In the U.S., the latest snapshot from the American Petroleum Institute gave a mixed picture, according to people familiar with the data. While nationwide oil inventories rose last week, they were lower at the key Cushing hub.

Oil markets remain backwardated, a bullish pattern marked by near-term contracts trading above those further out. Brent’s prompt spread was $1.21 a barrel, compared with $1.34 on Monday.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS