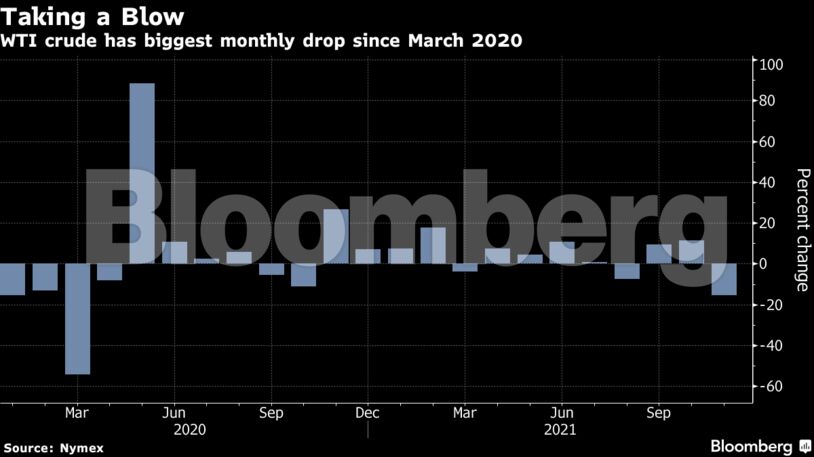

Oil has slumped almost 20% in November, set for the biggest monthly loss since March 2020, when the onset of the pandemic crushed global consumption. Investors are now seeking clues about the challenge posed by the omicron variant and how producers will respond. The Organization of Petroleum Exporting Countries and its allies will decide Thursday whether to pause a run of monthly supply hikes.

“There is elevated uncertainty on how omicron impacts oil demand, which is likely to keep oil prices volatile over the coming weeks,” said Giovanni Staunovo, an analyst at UBS Group AG in Zurich.

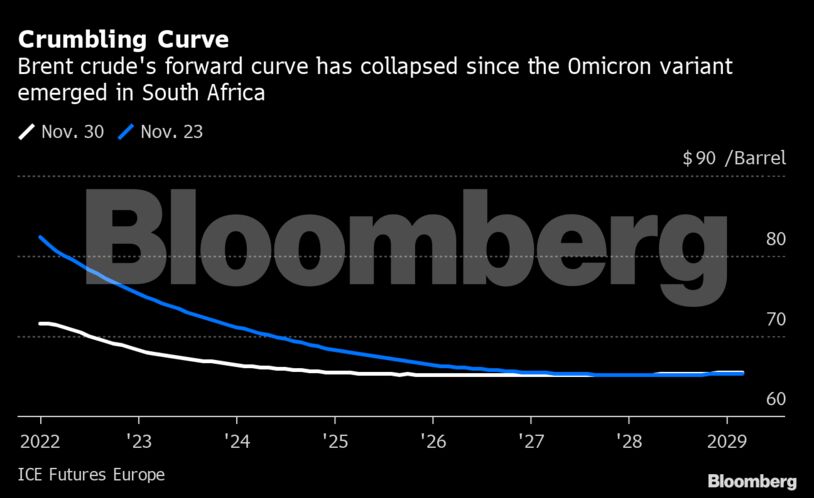

The weakness has hit the forward price structure for Brent that traders look to for clues on supply-demand.

Brent for January supply is poised to expire in a so-called contango on Tuesday, meaning that the most immediate price is lower than the following month. That’s a sign that expectations for short-term tightness have dissipated since the variant emerged in South Africa.

Premium of Brent to Dubai Oil Swap Dips After Futures Sell-Off

While expiry-day pricing is often highly volatile, the wider forward curve has also weakened noticeably, giving traders seeking yield by holding long positions less incentive to be invested. While much of the curve remains backwardated — where nearer-term prices trade above longer-dated ones — gaps between monthly contracts have narrowed.

The Biden administration said on Monday that it would proceed with a plan to draw 50 million barrels of oil from strategic reserves despite the recent drop in prices, and warned it could release even more onto the market. The move was made in coordination with other crude-consuming nations, including Japan.

| Prices: |

|---|

|

Oil traders are also tracking talks this week aimed at reviving Iran’s 2015 nuclear deal with world powers. Success at the negotiations in Vienna could lift sanctions on Iran’s economy, leading to a resumption in official oil flows. The exchanges began positively on Monday, according to a top European diplomat.

Macro-economic data from Asia pointed to improvements in leading economies, a positive signal for energy demand. In China, the manufacturing purchasing managers index returned to expansion, while factory output in Japan edged up.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS