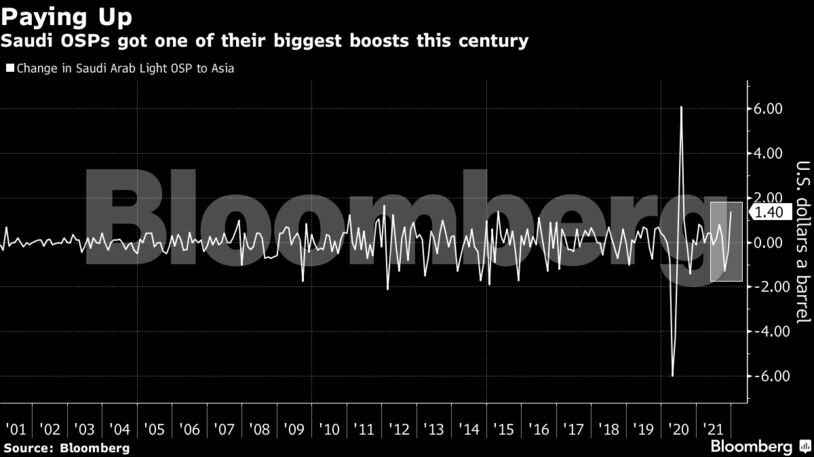

Saudi Arabia made some of the biggest increases to its official selling prices in decades at the end of last week, a move enabled by low global stockpiles and tight supplies, according to Vitol Group. In a further sign of robust demand, Asian buyers will probably take their full contractual volumes of oil next month, despite the higher costs.

There is little sign of bullish sentiment wavering in the market. Money managers still hold more than ten bullish bets for every bearish one in WTI, while nearby timespreads are in a backwardation of more than $1 a barrel, indicating tight supply.

Oil is edging back toward seven-year highs after the Organization of Petroleum Exporting Countries and its allies ignored calls from consumers to lift output by more than a planned 400,000 barrels a day. That has traders waiting to see whether the U.S. will release some of its Strategic Petroleum Reserve, potentially in co-ordination with other states, in a bid to cool prices.

The United Arab Emirates Energy minister said action by OPEC+ has prevented “us from having double or triple the prices, and that’s something we need to appreciate,” Suhail Al-Mazrouei told a conference in Dubai on Monday.

“The combination of an undersupplied oil market, low OECD inventories and the global energy crunch should keep oil prices at $80-$90 a barrel for the rest of the year,” said Helge Andre Martinsen, senior oil analyst at DNB.

| Prices: |

|---|

|

Adding to the positive sentiment Monday was another jump in European natural gas prices on signs that Russia might not be delivering a promised boost to supply. Swtiching from gas to oil has already boosted consumption, and BP Plc said last week that demand is back at 100 million barrels a day.

Attention will turn on Tuesday to the Energy Information Administration’s monthly report. Over the weekend, the U.S. Energy Secretary Jennifer Granholm flagged that data as something the Biden administration will be considering as it mulls a possible SPR release.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein