Oil prices hit a seven-year high in October and demand is now back above 100 million barrels a day, a level last seen before the Covid-19 pandemic, according to BP Plc. The energy crisis has also lifted demand, prompting Bank of America Corp. to say Brent crude will hit $120 a barrel by the end of June.

While OPEC+ is expected to confirm adding 400,000 barrels a day in December, there is “still some risk that they supply more, given the increasing political pressure they now seem to be getting from both the U.S. and other key consumers,” said Bjarne Schieldrop, chief commodities analyst at SEB AB.

Japan has called on the oil producing group to hold talks to stabilize the market. Over the weekend, U.S. President Joseph Biden urged the group to pump more. If OPEC+ doesn’t, the Biden administration is prepared to release crude from strategic reserves, according to RBC Capital Markets.

Stockpiles at the key U.S. storage hub in Cushing, Oklahoma, recently hit their lowest in three years. Later Tuesday, the American Petroleum Institute will issue estimates for Cushing as well as nationwide holdings.

| Prices: |

|---|

|

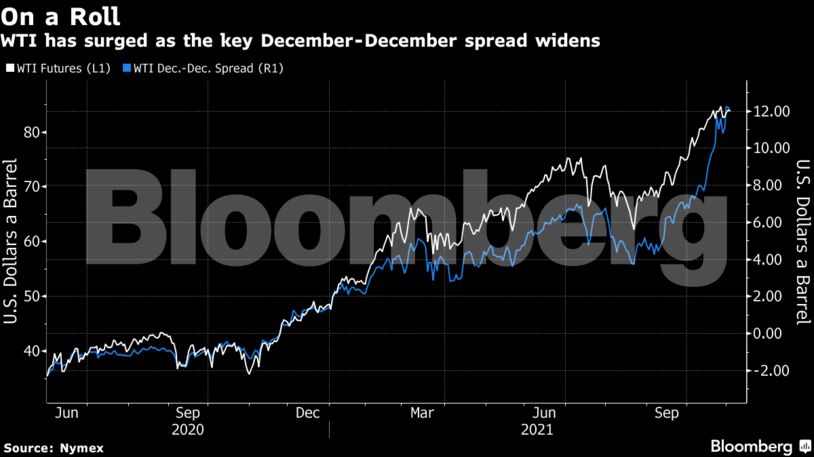

The crude market’s overall bullishness is reflected in strongly backwardated pricing patterns, with near-term contracts trading above those further out, pointing to tightness of supply. WTI for December is trading around $12/bbl higher than the same month in 2022.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS