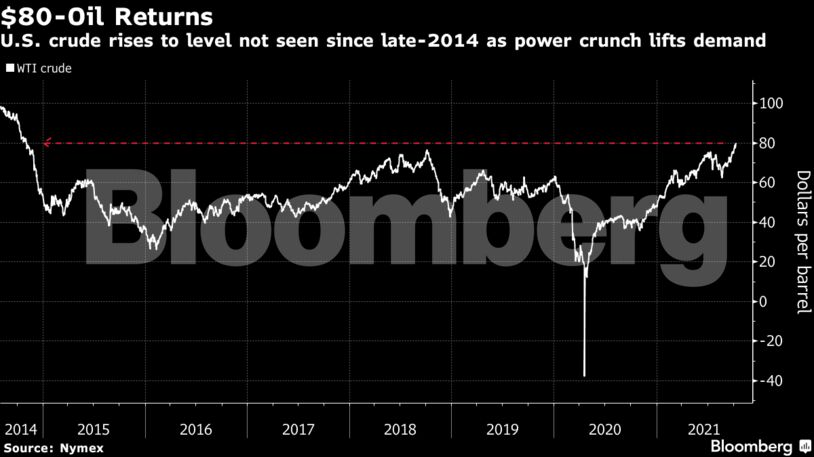

The American crude benchmark has risen almost 30% since mid-August as the energy crisis has intensified. Saudi Aramco estimates the gas shortage has already increased oil demand by around 500,000 barrels a day, while Goldman Sachs Group Inc. sees consumption climbing even higher. Concerns were compounded further after the U.S. Energy Department said it had no plans “at this time” to tap the nation’s oil reserves.

A decision last week by the Organization of Petroleum Exporting Countries and its allies to stick to a plan of returning just 400,000 barrels a day to the market in November has tightened the market. Many analysts had anticipated the group would pump more due to the crisis. WTI’s prompt timespread is now 69 cents a barrel in backwardation, a bullish structure where near-dated prices are higher than those further out, from 29 cents a week ago.

“OPEC’s decision to hold back from a bigger than scheduled increase in output is likely to see the market tighten further in the fourth quarter,” said Daniel Hynes, a senior commodity strategist at Australia & New Zealand Banking Group Ltd. The “market remains well bid as demand continues to grow,” he said.

| Prices: |

|---|

|

There’s a possibility that signs of slowing global growth will ease some of the demand pressure on crude, however. Goldman cut its forecasts for U.S. expansion this year and next, blaming a delayed recovery in consumer spending. The bank said in a note that it now sees growth of 4% in 2022, down from a previous estimate of 4.4%.

Iran, meanwhile, said over the weekend, that it plans to offer oil and gas condensate to “any investor” in exchange for either goods or capital investment in the Islamic Republic’s sanctions-hit energy sector. That comes amid stalled discussions to get an international deal on its nuclear program, which would allow it to start exporting oil officially again. The coming weeks will be decisive for Iran’s nuclear program, said German Chancellor Angela Merkel, urging Tehran to come back to the negotiating table.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS