Futures in New York lost 1.2%, declining from their strongest closing price since 2014. Commodities including copper and iron ore slid as the prospect for headwinds to China’s economy grows, while the dollar climbed, making energy and metals priced in the currency less attractive.

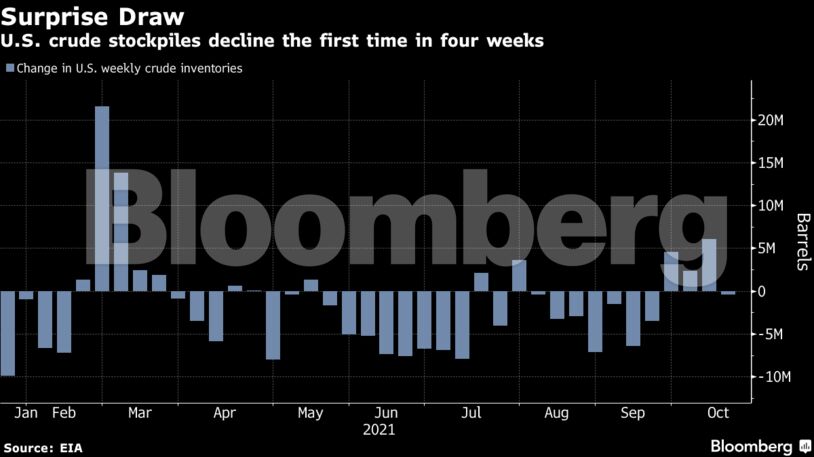

Behind weaker headline prices, the structure of the U.S. crude market was soaring as stockpiles continue to drain at the key hub of Cushing, Oklahoma. The closely watched spread between the nearest December contracts topped $10 a barrel Thursday, the strongest since 2013, while nearby spreads have surged to a three-year high.

The market has tightened significantly recently as coal and natural gas shortages drive greater crude consumption, underpinning a rally in prices. Saudi Arabia said any extra oil from OPEC+ would do little to tame the surging cost of gas, predicting demand may rise as much as 600,000 barrels a day if the northern hemisphere’s winter is colder than normal.

“Modest supply-growth amid recovering demand means that oil inventories are likely to continue to decline over the coming weeks and keep oil prices supported,” UBS Group AG analysts including Giovanni Staunovo wrote in a note.

| Prices |

|---|

|

India became the second major Asian oil importer this week to sound the alarm over high crude prices. The global economic recovery will become fragile if prices aren’t “predictable, stable and affordable,” Oil Minister Hardeep Singh Puri said at the CERAWeek India Energy Forum on Wednesday, echoing the sentiments of Japanese Prime Minister Fumio Kishida.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire