Futures were little changed after closing 1.5% higher on Monday. Demand is being supported ahead of the northern hemisphere winter by shortages of natural gas and coal, triggering a need for alternative power generation fuels such as diesel and fuel oil. Caution from the Organization of Petroleum Exporting Countries and its allies in restoring supply is adding to upward price pressure.

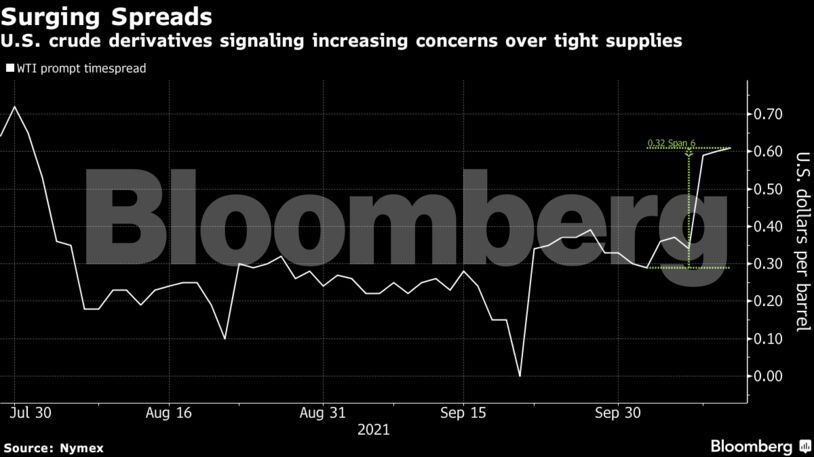

The mismatch in demand and supply could quickly drain inventories. The gap between West Texas Intermediate’s two nearest contracts has widened in recent days in an indication that stockpiles at the key U.S. storage hub of Cushing, Oklahoma, are set to shrink.

Global inventories may dwindle to their lowest level on record in terms of days-of-cover by the end of this year, Citigroup Inc. said Monday, when it increased its fourth-quarter Brent forecast to $85 a barrel and said it may touch $90 at times. UBS Group AG raised its forecast for both New York and London oil because of stronger demand from the power sector and reviving U.S. jet fuel consumption.

“Gas-to-oil switching and the potential for a colder winter in the northern hemisphere will underpin the demand front,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates.

| Prices: |

|---|

|

The revival in demand comes after last year’s record slump as the pandemic ravaged the world. The improving metrics are also evident in long-suffering refining profits.

In Europe, margins have climbed from “essentially zero in June” to near pre-pandemic levels, partially driven by stronger demand for diesel and jet-type fuels, Citi said in a separate report. In Singapore, complex margins have risen to the highest in two years, while those for diesel are near a 21-month high.

Still, the pace of oil’s surge, combined with surging prices of other energy commodities and metals is bringing on inflation and threatening to hit economies reviving from the pandemic slump. Industries in Europe are being forced to crimp or shut operations. That, in turn, could weigh on oil demand.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS