A natural gas flare on an oil well pad burns as the sun sets outside Watford City, North Dakota January 21, 2016. REUTERS/Andrew Cullen

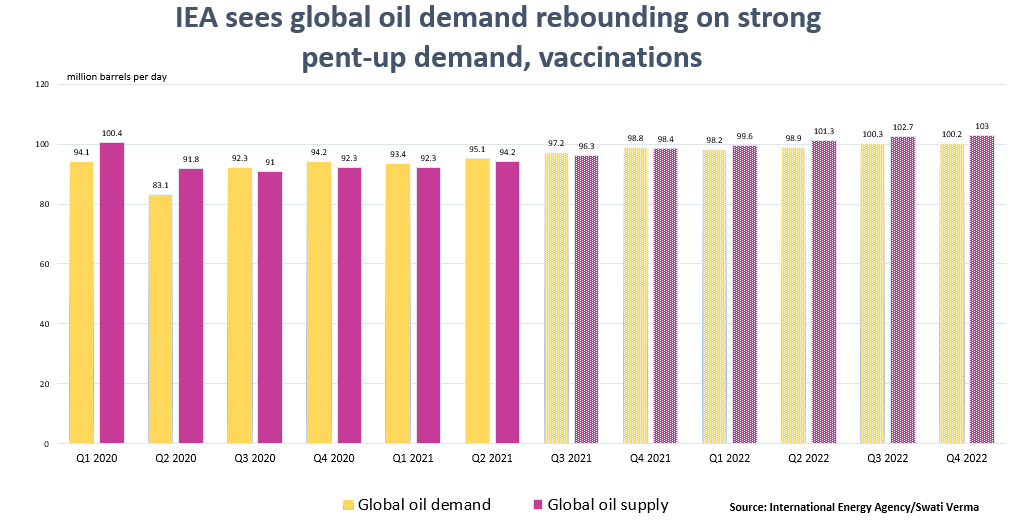

Sept 30 (Reuters) – Oil prices will see modest gains for the rest of the year and into 2022 as consumption resumes its recovery to pre-pandemic levels, with a likely COVID-19 resurgence still looming large over the outlook, a Reuters poll showed on Thursday.

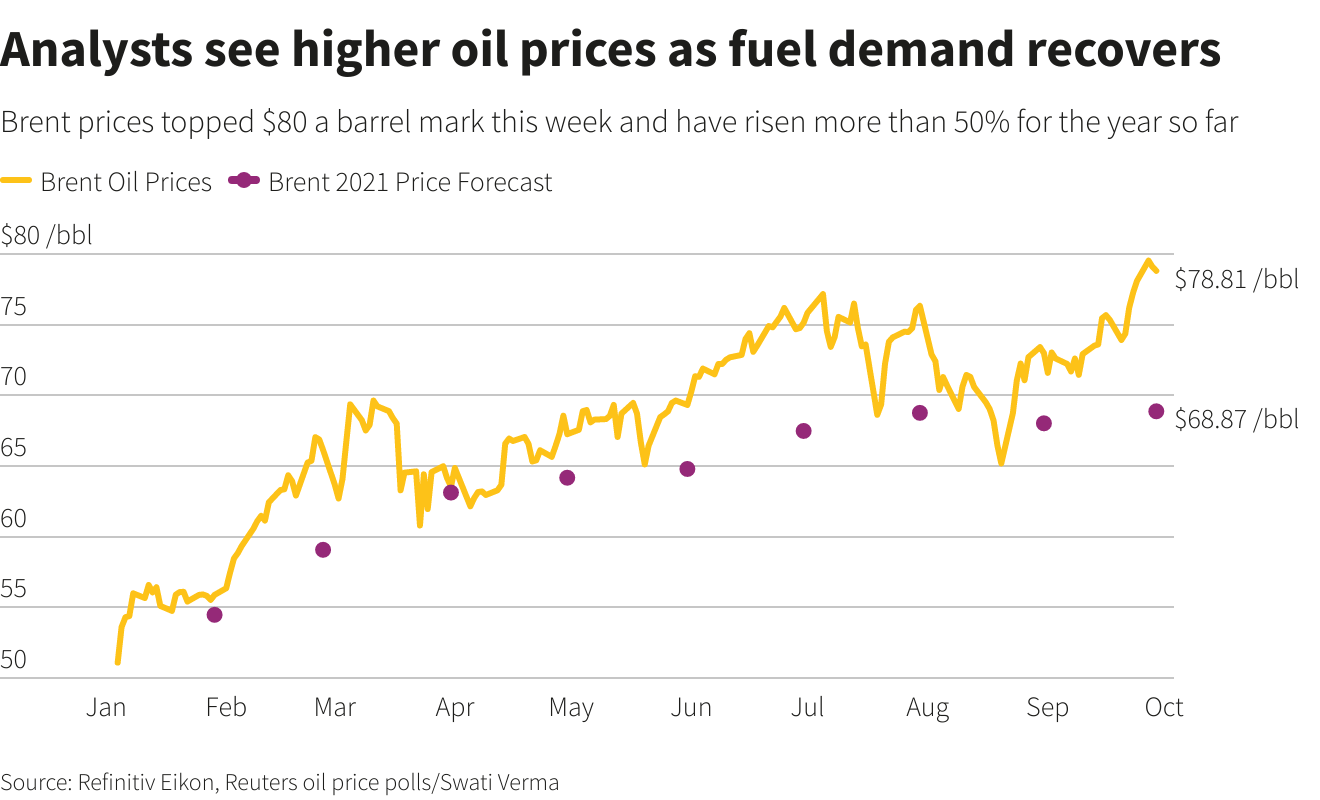

The survey of 39 participants forecast Brent would average $68.87 per barrel in 2021, up from the $68.02 consensus in August, when the Delta variant’s spread prompted the first downward revision in the 2021 outlook in about nine months.

Citing a faster fuel demand recovery and storm-led Gulf of Mexico supply disruptions, Goldman Sachs recently hiked its year-end Brent forecast to $90, but flagged a potential new virus variant and a ramp-up in OPEC+ production as risks. read more

“Demand growth will continue to support oil prices, balanced by the expected increase in OPEC+ production between now and the end-2021,” Ann-Louise Hittle, vice president, oils research at WoodMac said.

Brent has averaged about $68 this year, but topped $80 a barrel mark this week amid growing demand and expectations that producers will decide to keep supplies tight when the Organization of the Petroleum Exporting Countries meets next week.

“OPEC+ will be cautious in adding barrels, but does not want prices to move past $80 for any sustained period of time in part because of concerns of the impact on the sustainability of the economic recovery and the long-term impact on demand,” said John Paisie, president of Stratas Advisors.

“They’re still worried about U.S. shale producers ramping up production,” Paisie added.

Julius Baer analyst Norbert Rücker said “occasional pandemic hiccups” added a level of uncertainty, while growth rates should slow as economic activities return to pre-pandemic levels.

The poll forecast U.S. crude to average $66.13 per barrel in 2021 versus $65.63 last month.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS