West Texas Intermediate edged up after hitting the highest intraday level since early August on Wednesday. U.S. crude inventories dropped by more than 6 million barrels last week to a two-year low, according to government figures.

Meanwhile, gas and power prices are surging, adding to expectations for a lift in consumption as winter draws closer in the northern hemisphere. Citigroup Inc. says there could be a temporary boost of as much as 2 million barrels a day in diesel demand as high gas prices force consumers to switch.

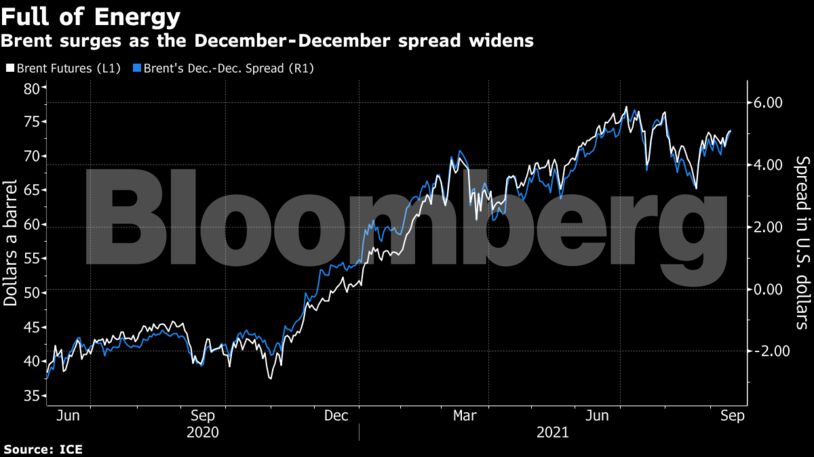

With those bullish factors coalescing, key timespreads have widened, signaling investor optimism. Trading of bullish Brent options also surged to a two-month high on Wednesday.

Crude’s rally has been reinvigorated since mid-August, with WTI on course for a fourth straight weekly gain. Inventories have been falling as coronavirus vaccination programs permit economies to reopen, aiding mobility. The loss of U.S. output from Hurricane Ida’s hit more than two weeks ago has offset extra barrels from the Organization of Petroleum Exporting Countries and its allies.

Prices have been pushed higher in recent days “by supply outages combined with expectations of switching from gas to oil in the power sector,” said Helge Andre Martinsen, a senior oil market analyst at DNB Bank ASA. “We still believe in softer prices toward year-end and early next year as curtailed production returns and OPEC+ continues to increase production.”

| Prices: |

|---|

|

Chevron Corp. Chief Executive Officer Mike Wirth warned this week that the world is facing high energy prices for the foreseeable future. Strong prices for gas, liquefied natural gas and oil are expected to last “for a while” as producers resist the urge to drill again, he told Bloomberg News. Norway’s Equinor said Thursday it also expects European gas prices to remain high over winter.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Busting Biases, Boosting Innovation – Geoffrey Cann