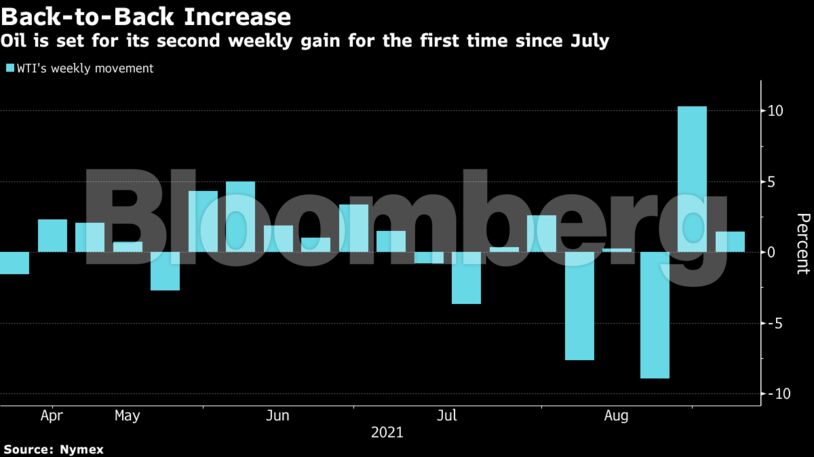

Oil has climbed as the market appears set to remain in deficit even as the Organization of Petroleum Exporting Countries and its allies push ahead with reviving supply and concerns persist about the impact of the pandemic on energy demand. OPEC+ has said crude stockpiles in developed countries are falling and an economic recovery is accelerating.

There have been signs of revival in Asia, where Covid-19 infections had surged. China’s independent refiners are buying more crude and gasoline consumption in India in improving. The return of Iranian supply also looks even further away.

“Oil prices continue to trade at relatively elevated levels despite OPEC+ reaffirming plans to normalize output and Covid-19 demand woes still present,” said Jens Pedersen, senior analyst at Danske Bank. “A strong jobs report could reverse the drop in the dollar and hit oil prices,” while the market continues to assess the impact of Hurricane Ida, he said.

Further details on the disruption from Ida may come later Friday when President Joe Biden visits Louisiana to survey some of the damage. He will meet with Governor John Bel Edwards and local officials in the state, where hundreds of thousands of homes and businesses remain without electricity.

| Prices: |

|---|

|

Options markets have also mirrored the positive sentiment in crude. The premium of bearish put options for global Brent benchmark over bullish calls fell to its narrowest since mid-June this week. That’s a sign that traders aren’t paying as much to protect against falling prices.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire