In Asia, traders digested a plan by China to sell oil from its strategic reserves for the first time, part of a campaign by Beijing to try to keep commodity prices in check. The initial auction on Sept. 24 will be for about 7.38 million barrels, the National Food and Strategic Reserves Administration said Tuesday. While that’s relatively small — less than the country typically imports in a single day — the planned sale may be followed by further offerings.

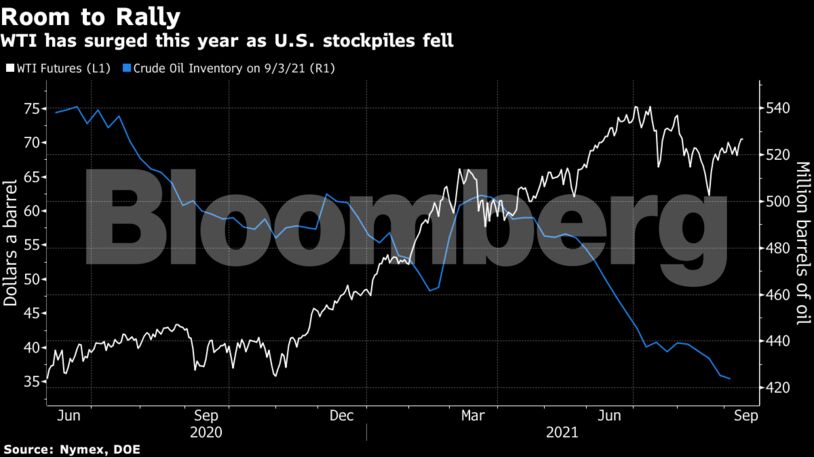

Oil has risen in recent weeks, paring a quarterly loss, as extreme weather disrupted U.S. production, and figures showed a further drawdown in inventories amid the pandemic. The International Energy Agency said on Tuesday the world will have to wait until October for additional supplies as output losses from Hurricane Ida offset increases from OPEC+. But there remain risks with China locking down a city of 4.5 million people to curb the spread of the virus.

“There is news of new Covid cases in China but that is offset by renewed large inventory declines in the U.S.,” said Giovanni Staunovo, commodity analyst at UBS Group AG. “My guess is it is driven by CTA and momentum buyers.”

| Prices: |

|---|

|

The API snapshot also pointed to lower holdings of gasoline and distillates, with a combined fall of about 5.7 million barrels. Last week, the government reported gasoline inventories hit the lowest since November 2019.

See also: Oil Glut That Covid Built Is Now All But Gone

U.S. oil production in the Gulf of Mexico has been coming back online slowly after Ida swept through the region more than two weeks ago. Another hurricane this week, Nicholas, didn’t impact offshore output, but briefly shut the country’s largest gasoline pipeline.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein