The sale comes after crude prices have dropped 15% since touching a 6 1/2-year high in early July as the spread of the delta variant threatens to derail the economic recovery and return to business as usual. Companies including BlackRock Inc. and Jefferies Financial Group Inc. are postponing plans to return workers to offices.

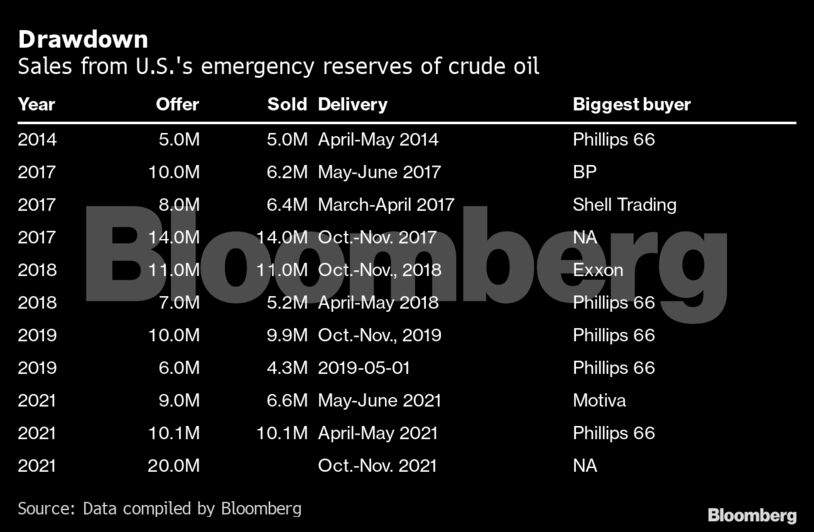

But the U.S. won’t have problems to sell the barrels because production hasn’t entirely caught up with demand, according to John Coleman, an analyst for North American crude markets at Wood Mackenzie Ltd. The market will still be in a deficit in the fourth quarter, and the 20 million barrels released from the nation’s emergency reserves should be absorbed.

The reserve, created in 1975 to serve as an emergency stockpile, held 621 million barrels in four underground caverns as of Aug. 13, Energy Department figures showed.

Benchmark American crude futures rose almost 5.3% on Monday in New York amid a broader rally in commodities and equity markets.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS