Wednesday’s multipronged rhetorical offensive followed persistent GOP criticism that its policies are causing inflation to spike, especially with passage early Wednesday of a $3.5 trillion budget blueprint. Republicans already are using that argument to try to regain control of Congress ahead of November 2022 midterm elections.

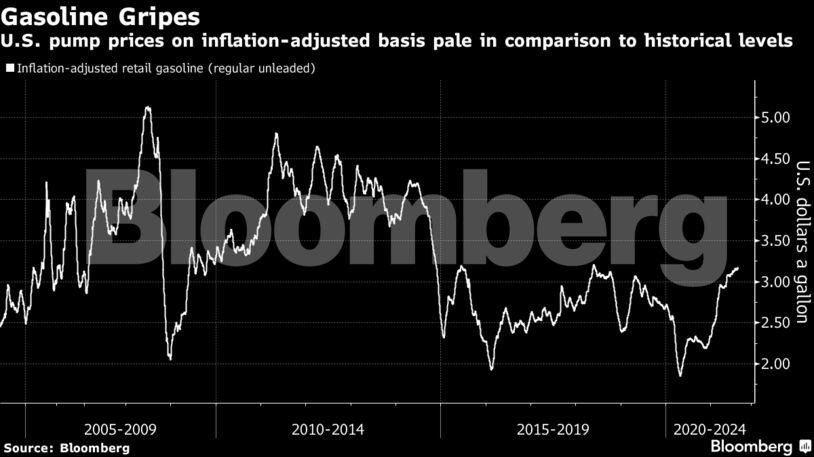

But the actions come as retail gasoline prices appear to have peaked, with the U.S. government forecasting prices will fall from an average of $3.12 a gallon in August to $2.82 a gallon in the fourth quarter. Increasing Covid-19 infections may cause demand to depress prices even more.

New inflation data showed gasoline prices rose in July by 2.4% from a month earlier. Over the last 12 months, gasoline prices have risen 41.8%, according to the U.S. Bureau of Labor Statistics — though gas prices were also depressed over the last year as more Americans stayed home during the pandemic. The daily national average price at the pump stood at $3.19 a gallon Wednesday, according to the American Automobile Association.

“Production cuts made during the pandemic should be reversed as the global economy recovers in order to lower prices for consumers,” Biden said Wednesday at the White House.

The administration’s move was likely timed to coincide with the inflation announcement, said Height Capital Markets analyst Benjamin Salisbury. “The rising inflation narrative – especially fuel prices – is the number one risk to Biden’s infrastructure, American Jobs Plan and American Families Plan agendas and the Democrats’ re-election prospects,” Salisbury said by email.

Energy analysts have said the administration knows it needs to show concern on oil and gas prices. If the actions come ahead of sustained price drops or production agreements, the statements help show the administration was effective, they said.

Administration officials said the comments on oil weren’t timed to the release of inflation data. Instead, they said it’s part of an ongoing effort to keep prices low for middle class families.

“We don’t see it through a political lens,” White House Press Secretary Jen Psaki said Wednesday. “We believe this needs to be a continuous and ongoing conversation and we need to elevate this issue in public and certainly in the global community.”

The Biden administration’s move appeals to voters, particularly during summer months when prices typically rise as demand for gasoline increases, said Celinda Lake, president of Lake Research Partners and one of the lead pollsters for Biden’s campaign in 2020.

“This type of response from the White House is very, very popular with the voters, who have a suspicion this is just price gouging,” Lake added. “The actions they took today shows they are in touch and have a strong agenda of getting rising costs under control.”

Biden’s economic agenda includes a promise to not raise taxes on middle-class Americans, including at the pump.

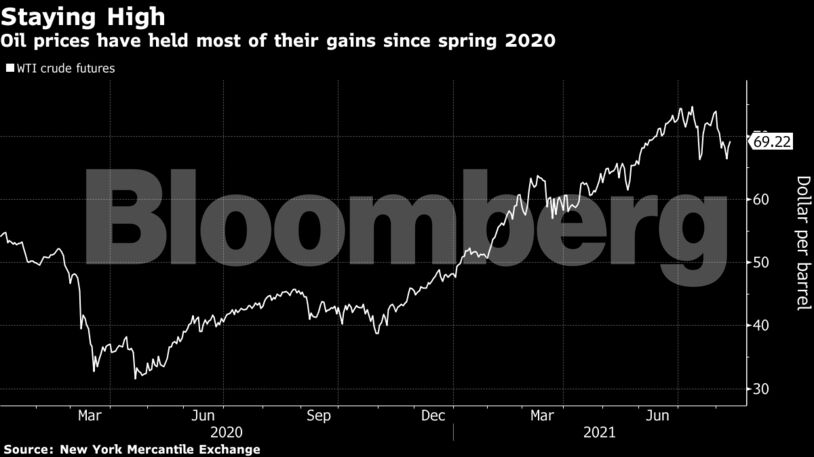

Oil dropped suddenly on the White House’s announcement before rebounding. A weaker dollar offset a government report that showed a smaller-than-expected decline in crude stockpiles, thanks in turn to a surge in Covid-19 cases. Crude futures settled 1.4% higher in New York after falling as much as 2.4% earlier.

The U.S. has urged OPEC+ in the past to increase supply, most recently in April when Energy Secretary Jennifer Granholm called her Saudi counterpart Prince Abdulaziz bin Salman to highlight the importance of “affordable energy.”

The 23-nation OPEC+ alliance led by Saudi Arabia and Russia agreed in July to revive the rest of the production they halted during the pandemic in careful installments, of 400,000 barrels a day each month.

Republicans wasted little time in criticizing the administration’s moves.

“It’s pretty simple: if the president is suddenly worried about rising gas prices, he needs to stop killing our own energy production here on American soil,” Republican Senator John Cornyn of Texas said in a statement. “Begging the Saudis to increase production while the White House ties one hand behind the backs of American energy companies is pathetic and embarrassing.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet