“The ongoing battle against the latest virus outbreak is showing up in economic data, and when the reading is disheartening in the world’s second-biggest economy investors take notice,” said Tamas Varga, an analyst at PVM Oil Associates Ltd.

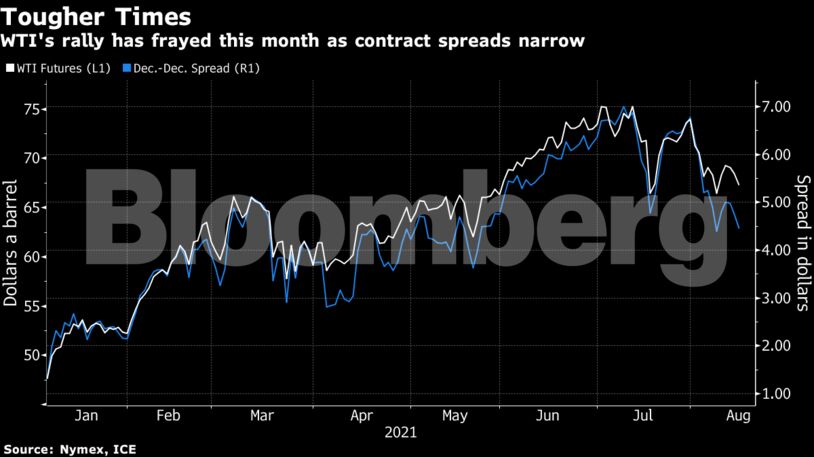

After a vigorous rally in the first half of the year, crude’s advance has been checked in recent weeks. The delta variant has spurred fresh curbs on mobility in many nations including China, harming energy consumption. Against that backdrop, JPMorgan Chase & Co. has been among banks reducing oil price forecasts.

| Prices: |

|---|

|

While demand has been challenged, the Organization of Petroleum Exporting Countries and its allies including Russia have stayed the course in relaxing their output curbs imposed in the early phase of the pandemic. Supplies will rise by 400,000 barrels a day this month.

With prices softening OPEC+ delegates said they don’t see a need to accelerate the revival of output, despite a call from U.S. President Joe Biden last week for the cartel to restore more production to bring gasoline prices down. The group’s next regular meeting is set for Sept. 1.

Still, Goldman Sachs Group Inc. is standing by a forecast that Brent will hit $80 a barrel next quarter amid a sustained supply deficit as it expects delta’s hit to consumption to be transient.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire