China’s government has imposed fresh curbs on travel to combat the highly infectious strain of the coronavirus. Meanwhile in the U.S., oil inventories unexpectedly rose last week, pressuring prices. Still, sentiment in other risk assets is improving, with European equities trading higher for a fourth day.

The oil-market mood is “shifting from demand-destruction fear to realization that the market is still in deficit and demand likely still recovers, though in an uneven way,” said Giovanni Staunovo, an analyst at UBS Group AG. “Delta-related concern will keep prices volatile.”

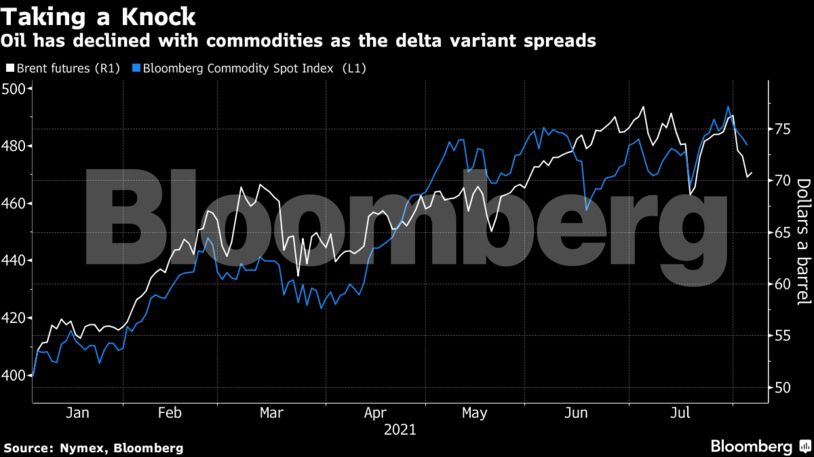

Delta’s spread is challenging the global recovery, which had driven prices of commodities to multiyear highs late last month. The impact of the latest Chinese outbreaks can already be seen, with traffic thinning on some of the country’s typically busy city roads.

| Prices: |

|---|

|

New travel and movement restrictions in China include the capital, Beijing. Meanwhile Hong Kong has reimposed quarantine on travelers from the mainland, though an exception remains in place for the southern Guangdong province, a neighbor to the financial hub.

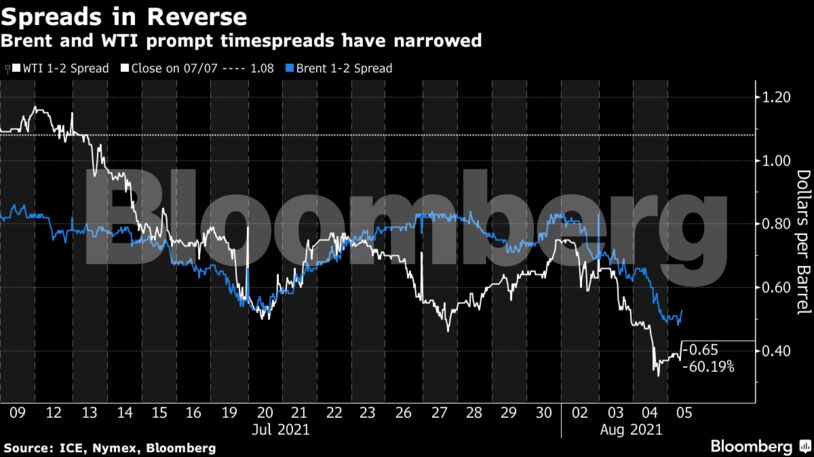

Prompt timespreads — the gap between the most immediate futures contracts and those a month later — have slumped in recent days, pointing to declining confidence in the market. First-month WTI was trading at a premium of 44 cents a barrel to the next month on Thursday, down from 75 cents at the start of this week. Brent’s structure has seen a similar retreat.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein