The project announcements highlight the at-times confusing signals emanating from Beijing as officials vacillate between aggressive measures to reduce carbon emissions and heavy industry-focused spending to maintain the economic recovery from the pandemic.

Construction began on 15 gigawatts of new coal power capacity in the first half, while companies announced 35 million tons of new coal-based steel-making capacity, more than in all of 2020. New steel projects typically replace retiring assets, and while that means total capacity won’t rise, the plants will extend the use of mainly blast furnace technology and lock the sector into further coal dependency, according to the report.

Decisions on permitting new projects will be a test of China’s commitment to reduce coal use from 2026, and also highlight the impact of the Politburo’s recent instructions to avoid “campaign-style” emission reduction measures, a message that’s been interpreted as China slowing the environmental push.

“The key questions now are whether the government will welcome the cooling of emissions-intensive sectors or whether it will turn the tap back on,” CREA researchers said in the report. “Permitting decisions on recently announced new projects will show whether continued investment in coal-based capacity is still allowed.”

China limited emissions growth in the second quarter to a 5% increase from 2019 levels, after a 9% rise in the first quarter, CREA said. The slowdown shows that peaking carbon emissions and controlling financial excesses may be gaining priority over stimulus-fueled economic growth.

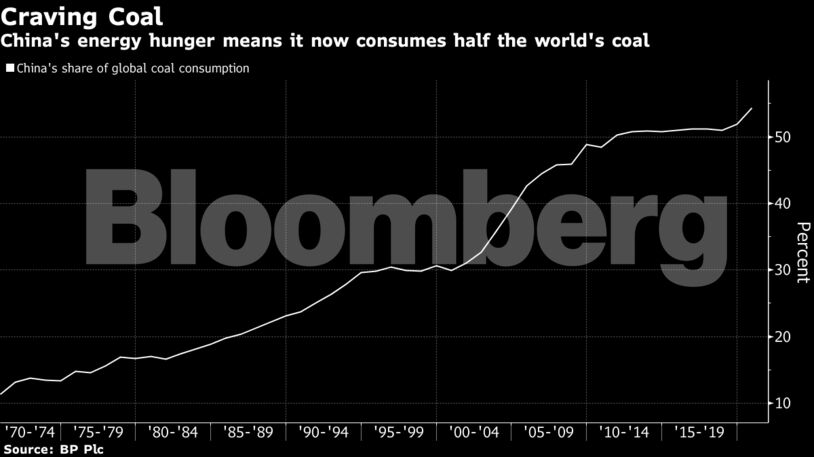

President Xi Jinping has set a goal to peak carbon dioxide emissions by 2030 and to zero out all greenhouse gas emissions by 2060. Earlier this week, the United Nations published a report pinning responsibility for climate change on human behavior, with UN Secretary-General Antonio Guterres saying it must be seen as a “death knell” for fossil fuels like coal.

“China’s ability to curb its CO2 emissions growth and realize its emission targets crucially depends on permanently shifting investments in the power and steel sectors away from coal,” CREA said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein