Futures in New York fell below $74 a barrel after rising more than 2% on Friday. While the rollout of vaccines and the revival of major economies have helped boost fuel consumption, the spread of the highly infectious delta variant and uncertainty over supply from the OPEC+ alliance are clouding the outlook.

There are also signs that China’s recovery is slowing. Its economy was always expected to descend from the heights hit during its initial rebound, but economists say the softening has come sooner than expected.

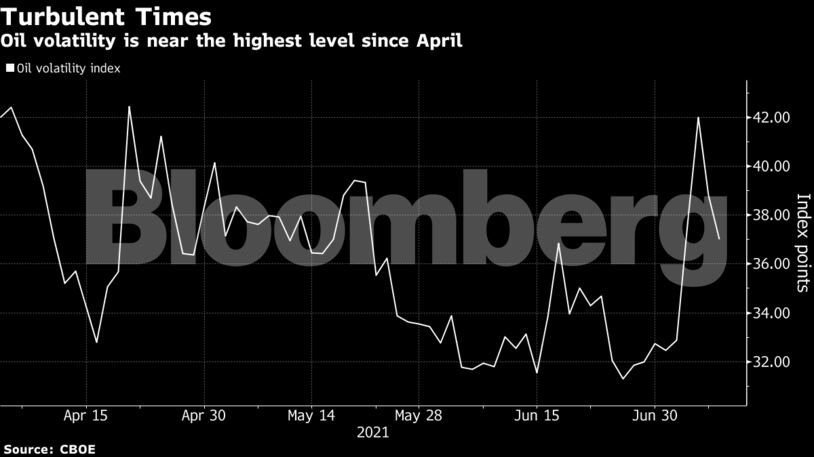

Oil’s upward momentum was interrupted last week after an OPEC+ meeting on output levels was abandoned amid deadlock between producers. Crude capped its first weekly loss since May — despite an end-of-week rally — on concern that the impasse could lead to another price war. The alliance had been widely expected to restore more of the production it idled during the pandemic.

“There is some weaker Chinese data, but also the rise of the delta variant in Europe is causing some doubts on the demand recovery,” said Hans van Cleef, senior energy economist at ABN Amro. Additionally, there’s the question of whether OPEC+ will find a solution and increase production, he said.

| Prices |

|---|

|

The International Energy Agency will provide investors with a snapshot of the market on Tuesday with the release of its monthly report, while OPEC will release its own monthly report on Thursday.

The market’s bullish structure has eased slightly amid the OPEC+ uncertainty. The prompt timespread for Brent is 77 cents a barrel in backwardation — where near-dated contracts are more expensive than later-dated ones — compared with 99 cents a week ago.

The coronavirus remains a constant source of concern. The U.S. reported the most cases since mid-May as delta takes hold in less-vaccinated areas. French officials warned of a new wave, while U.K. Prime Minister Boris Johnson will instruct people to stay vigilant as he prepares to lift most remaining restrictions in England. In Asia, Indonesia is in the throes of a major outbreak and case numbers are also high in Thailand and Malaysia.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire