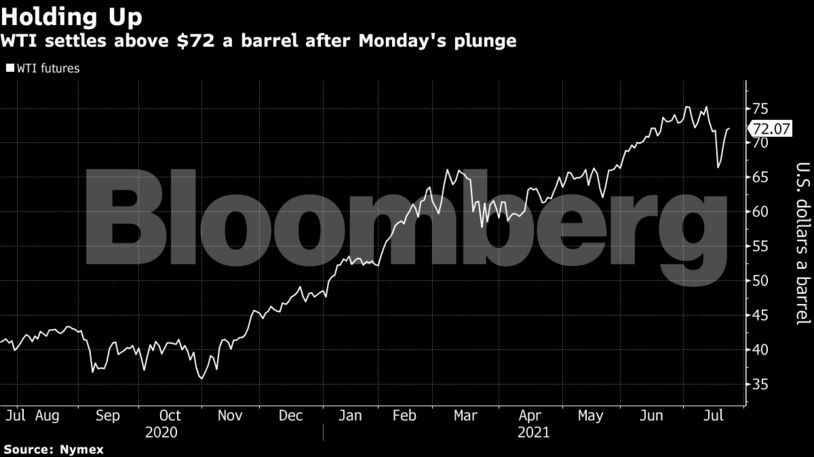

Crude has rallied nearly 50% this year as ongoing vaccination campaigns have propelled reopenings. Data this week showed gasoline demand is essentially back to normal in many of the biggest consuming countries. Meanwhile, OPEC+ and U.S. shale producers have shown discipline in returning shuttered supplies to the market.

The 7.5% price slump on Monday came just a day after the Organization of Petroleum Exporting Countries and its allies led by Saudi Arabia and Russia finalized an agreement to gradually restore production they halted during the pandemic. OPEC+’s modest increase eased fears around concerns of oversupply.

“Everybody thinks they are going to flood the market, and then they take a step back and realize that, hey, they’re adding because the supply is being burned off,” said Phil Streible, chief market strategist at Blue Line Futures LLC in Chicago.

The recent dip in prices is a buying opportunity and Brent prices should hit $100 per barrel next year, said a group of analysts at Bank of America Corp. in a recent note to clients.

| Prices: |

|---|

|

This week, Schlumberger and Baker Hughes Inc. suggested the rebound in the U.S. shale patch will likely slow this year as companies keep a lid on spending. Despite a strong recovery in crude prices in 2021, the shale industry is largely resisting adding new supply.

Still, the virus continues to pose a challenge. The Olympics opening ceremony kicked off in a nearly empty stadium in Tokyo, amid a record number of new infections linked to the games. In China, there are signs that a fresh outbreak at the airport in the eastern Chinese city of Nanjing has quietly spread to other provinces.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS