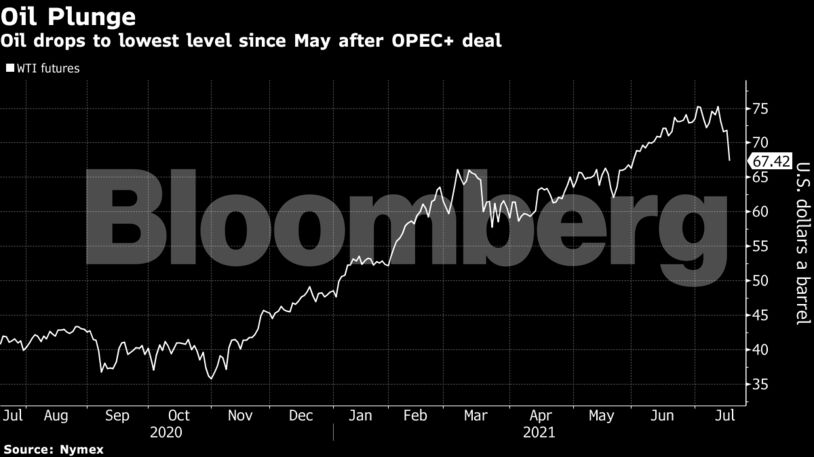

Futures in New York lost as much as 6.5% on Monday, the biggest decline since March. OPEC and its allies agreed to monthly supply hikes of 400,000 barrels a day, an increase that the International Energy Agency said “may go a long way” toward closing the supply deficit in the market. At the same time, the spread of the delta variant is stoking a risk-off mood in broader markets and threatening oil’s rally with fresh mobility restrictions around the world. The dollar also rose, reducing the appeal of commodities priced in the currency.

“Oil will probably dance to the tune of supply-side developments in the foreseeable future,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. in London. The delta variant’s spread is raising economic growth concerns, and “fears of inflation and therefore of interest-rates rise have resurfaced.”

Oil prices have been volatile over the last two weeks while OPEC+ remained in a dispute over adding supplies to the market. The deal was struck this weekend after Saudi Arabia and the United Arab Emirates reached a compromise on UAE’s demand for a more generous output limit. OPEC+ will now face a “new set of challenges” next year as rival supplies grow, said Toril Bosoni, head of IEA’s oil industry and markets division, in an email.

“As supplies from other producers not part of the deal rebound, and demand falls seasonally, stocks could see renewed builds early in the year,” she said.

While oil supply is set to rise, countries around the world are dealing with surges in new cases of Covid-19 as the highly contagious delta variant drives up infections. Indonesia surpassed India and Brazil in daily case numbers. U.S. infections are outpacing the global rate of increase, and the U.K. on Saturday reported the most cases since January.

“We’ve got risk aversion firmly in place and it’s all triggered by the spread of the delta Covid-19 variant,” said Ed Moya, senior markets analyst at Oanda Corp. “There’s this fear that you’re not going to have that strong economic recovery we were all hoping for in the second half of the year.”

| Prices: |

|---|

|

The delta strain may make oil volatile in the near term, but the deal between the Organization of Petroleum Exporting Countries and its allies would support a “constructive” view on prices, Goldman Sachs Group Inc. said. OPEC+’s planned supply increase is “moderate,” keeping the market in deficit, the bank said.

The agreement spans more than a year and covers millions of barrels of production, but it also remains flexible. The alliance will continue to hold talks every month from September, including a review of the market in December. It could adjust the schedule if required, according to Saudi Energy Minister Prince Abdulaziz bin Salman. The next gathering is scheduled for Sept. 1.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS