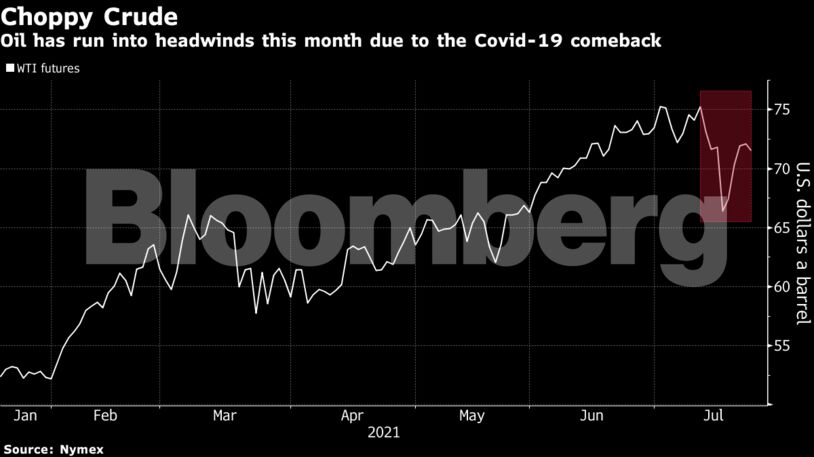

The latest virus flare-up has coincided with a salvaged OPEC+ agreement to add more barrels from August, whipping up stiff headwinds for oil and interrupting a price rally. Expectations are for a continued tightening of the market throughout the rest of 2021, however, leading to even higher prices.

Crude’s recent bout of price volatility comes hot on the heels of one of the biggest speculative washouts in years. Money managers cut their net-long positions in WTI by the most since 2017 last week. Traders are now keenly focused on whether the delta variant will spark a renewed selloff in crude.

“Uncertainties surrounding the delta variant are set to persist for a while yet,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. Still, the oil market is expected to remain in deficit, which will keep a floor under prices, he said.

| Prices |

|---|

|

The prompt timespread for Brent was 68 cents a barrel in backwardation — a bullish market structure where near-dated prices are more expensive than later-dated ones. That compares with 88 cents at the beginning of July.

Covid-19 infections globally increased the most in two months as the spread of the delta variant, a surge across the U.S., and low levels of vaccination in most Southeast Asian nations led to higher numbers. Countries including Thailand and Vietnam are imposing curfews in cities to battle the surge in cases.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein