“The message that we very strongly got was that the expenditure path set out in the budget will be stuck to, regardless of where oil prices go to, which I think is the right thing to do,” Tim Callen, the IMF mission chief to the kingdom, said in an interview late Monday. Sticking to targeted spending “allows you then to really build the financial assets that have been run down in recent years.”

Crude prices around $75 a barrel are only slightly lower than what Saudi Arabia needs to balance the budget, according to IMF estimates. They may rise further as the global economy rebounds from the impact of the pandemic and the International Energy Agency warned on Tuesday that the oil market would remain tight unless Saudi Arabia and its OPEC+ allies boost production.

“In the past, the weakness of the Saudi budget process was as oil prices go up spending would go up, and when prices turn around you then have to make difficult decisions,” Callen said. “We don’t think that pro-cyclicality is helpful for the economy, so it’s exactly right to stick with the expenditure as it was set out, even if oil prices are higher.”

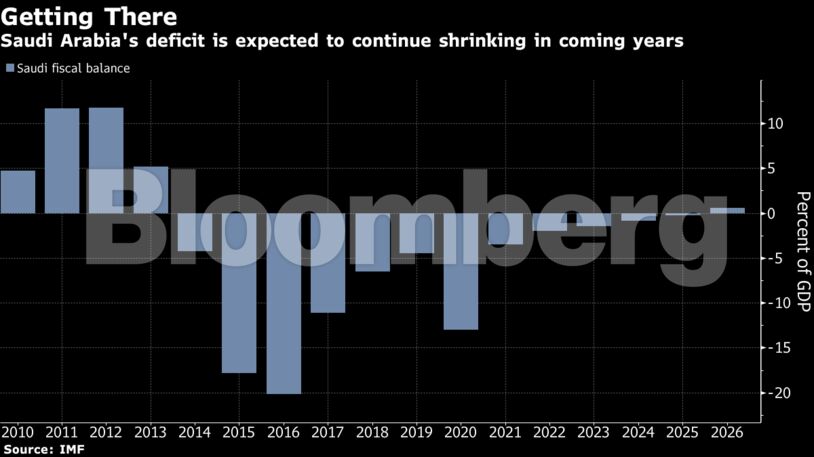

Saudi Arabia set spending this year at 990 billion riyals ($264 billion), while revenue is projected to rise to 849 billion riyals. As a result of that deficit, and transfers to the kingdom’s sovereign wealth fund, net foreign assets dropped to their lowest level in about 10 years in May.

The Arab world’s largest economy contracted sharply in 2020 due to the double shock of lower oil prices and the coronavirus pandemic. The government took measures to cushion the fiscal impact, tripling the value-added tax, cutting expenditure plans and raising import fees.

While Crown Prince Mohammed bin Salman has suggested the VAT hike was a response to Covid-19 and the rate could be reduced in the next few years, the IMF advises against it. “Having now raised the VAT rate, it is important that it stays where it is,” Callen said. “You don’t want to use tax rates in a pro-cyclical or even a counter-cyclical way.”

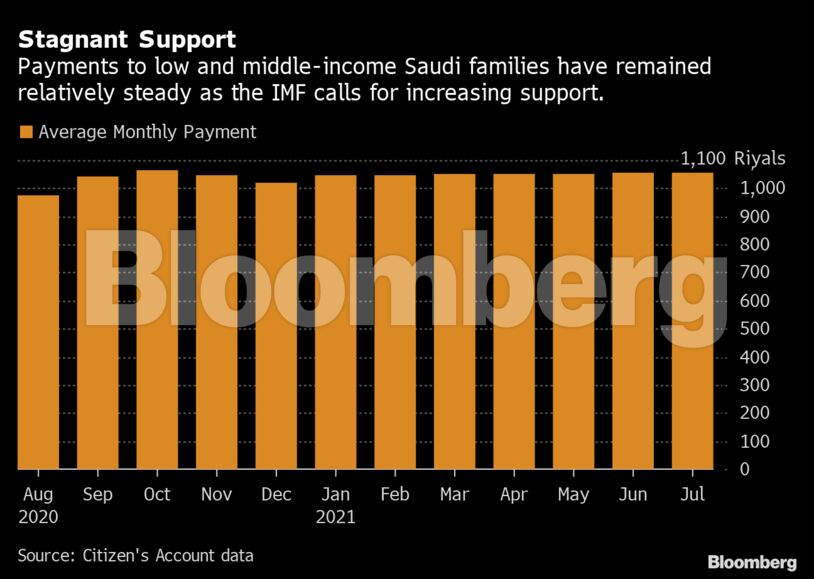

The IMF also suggested the government could afford to use more targeted financial support for low-income households. The kingdom, which has been reducing fuel subsidies, set an upper limit for the domestic cost of gasoline last week and said the state would shoulder the burden of prices above that level.

Rather than imposing a cap, Callen said the government should use a program called the Citizens Account to direct financial support to low-income households. “Stick with the reforms that you’ve been doing and don’t reverse them,” he said.

The IMF is also giving technical assistance to the Saudi government in managing its sovereign asset liability, Callen said.

More from Callen:

- Non-oil growth is sustainable, at least in the range of 3.5% to 4.5%.

- “Year-on-year growth in the second quarter should be strong because it was so weak in the second quarter of last year,” he said. It is expected to slow afterward “but it will remain relatively robust going forward.”

- Saudi Arabia needs to continue liberalizing the labor market if it wants to become a regional business hub.

- It is important to include the Public Investment Fund, a sovereign wealth vehicle, in the fiscal framework.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein