“To maximize shareholder value we ran a fair and comprehensive strategic review and as a result Brookfield increased its offer by approximately 21%,” Inter Pipeline Chair Margaret McKenzie said in a statement Tuesday night. The improved terms make it “appropriate to recommend acceptance of the revised Brookfield offer to our shareholders.”

The pursuit of Calgary-based Inter Pipeline follows years of failed attempts to build major energy infrastructure projects including TC Energy Corp.’s Keystone XL and Energy East, which has made existing lines potentially more valuable. Inter Pipeline owns pipeline infrastructure across Western Canada, connecting oil and natural gas producers with domestic and foreign customers.

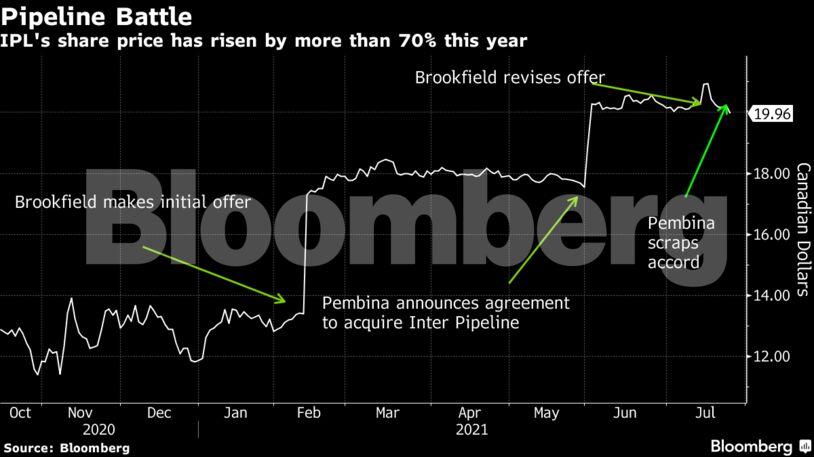

The drama began in February with an unsolicited C$7.1 billion offer from Brookfield that was rejected by the company’s board, which later endorsed a June 1 takeover offer by Pembina. Brookfield countered by boosting its offer multiple times.

Brookfield’s latest offer comprises C$20 per Inter Pipeline share in cash or 0.25 of a Brookfield Infrastructure Corp. share, subject to proration.

Inter Pipeline said it’s paying a C$350 million termination fee to Pembina as part of their agreement.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein