All told, the forthcoming wind, solar and battery-storage projects are worth an estimated $20 billion to $25 billion, the American Clean Power Association said.

“We’re not tapping the brakes,” said Philip Moore, senior vice president of Danish power giant Orsted A/S’s North American onshore unit, which just finished building a large solar and storage complex to provide power for West Texas oil and natural gas fields. “Coming out of the storm, we continue to see Ercot as a growth market.”

The building boom demonstrates the appeal that wind and solar continue to have for investors as the green transition accelerates, with companies under increasing pressure from shareholders and environmental groups to tackle climate change. It also bodes well for U.S. President Joe Biden’s push to eliminate power-sector emissions, since Texas produces more electricity than any other state.

Just four months ago, the industry’s future in Texas was called into question after widespread blackouts during a deadly winter storm stoked speculation among some conservatives and fossil-fuel proponents that frozen wind turbines were to blame. Though gas plants also failed and were a bigger factor in the crisis, Republican lawmakers in the state considered slapping fees on new clean-power projects, a threat that made investors skittish. But the legislative session wrapped up recently without passage of a law imposing such fees.

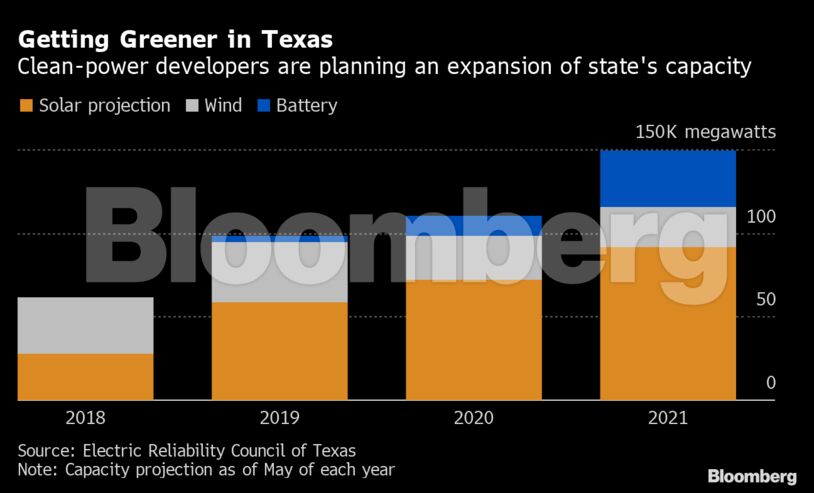

The amount of renewable energy in the Ercot queue in May was much higher than the same month in any of the past three years. That massive growth is driven by jumps in solar farms and battery storage that outweigh a drop in the amount of wind power in the queue.

New utility-scale solar installations in Texas totaled 3.3 gigawatts last year, nearly matching the 3.5 gigawatts of new wind, according to BloombergNEF. The research group projects more than double the amount of new utility-scale solar and 4.2 gigawatts of new wind there this year.

Republicans bashed renewable energy during and after the storm, even as the state’s grid operator said that frozen instruments at gas, coal and even nuclear plants were the main reason for the blackouts. “This shows how the Green New Deal would be a deadly deal for the United States of America,” Texas governor Greg Abbott told Sean Hannity on Fox News in the midst of the freeze. He went on to blame wind and solar power and said fossil fuel plants are necessary for baseline power.

Several renewable developers said new laws that targeted clean power projects would force them to rethink building in Texas. A group including big power companies, Amazon.com Inc. and Goldman Sachs Group Inc. sent letters to Abbott and lawmakers in April, writing that proposed new laws would chill investment in the state.

Despite the rosy data, the storm will have some effects on clean energy development in Texas. While projects are still moving forward there, developers and investors are rethinking their risk and some weaker projects may not get built in the wake of the storm, said Daniel Sinaiko, a lawyer who represents renewable energy clients for the law firm Allen & Overy. That could include projects that are higher risk, less certain to bring in a profit, or less likely to find a buyer after completion.

“The tax investors and the lenders are lining their contracts with covenants and reserves, things that cause the sponsor to be on the front edge of wearing the risks,” he said.

Some investors got burned by the Texas freeze and may be a little bit more hesitant to participate in future deals, said Oliver Metcalfe, a BNEF analyst. BNEF sees a drop-off in wind installations in Texas starting in 2022 as some wind developers race to start construction by year-end to qualify for a federal tax credit at existing rates, Metcalfe said.

One financial instrument that helped provide revenue for projects may no longer be viable as investors now want financing models to consider freak events like the February storm, said Lee Taylor, chief executive officer at clean-energy analytics firm RESurety. Under agreements called fixed volume swaps, projects must supply a fixed quantity of energy each hour whether the turbines are generating or not. Owners were hit hard during the Texas storm when prices spiked at the same time the cold had shut down projects.

Energy giant Enel SpA is spending $1.9 billion on solar, wind and storage projects in Texas. Georgios Papadimitriou, head of North America for Enel Green Power, said the U.S. is the biggest source of growth for the company and about 85% of that growth is currently in Texas. He expects to keep investing in the state unless the legislature there passes onerous new laws that target renewable energy.

“Texas has been for us and continues to be a key state for growth,” said Papadimitriou. “We have much bigger plans coming forward.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS