The alliance has delayed preliminary talks to allow members more time to resolve differences. While Russia has been weighing a proposal to hike output, Saudi Arabia has signaled it prefers a gradual approach amid fresh Covid-19 outbreaks in some regions, and Kuwait has said the group remains cautious.

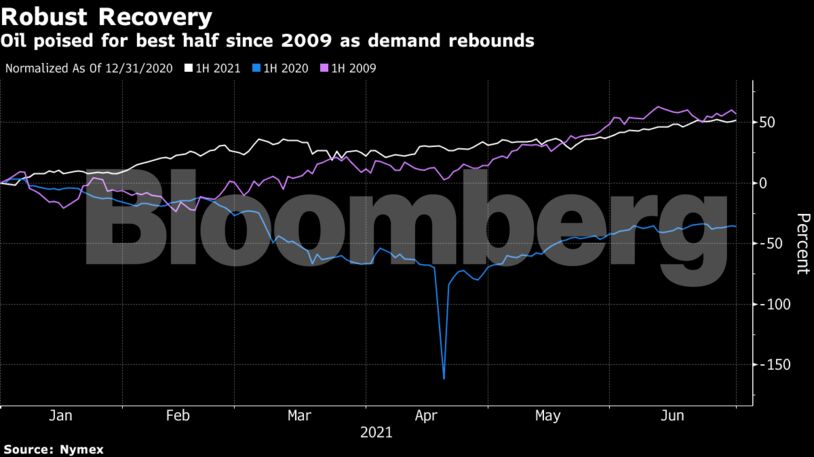

The recovery in key economies such as the U.S. and China has helped underpin a surge in fuel use and sent crude prices to the highest since 2018. OPEC+ sees the market in deficit for the rest of this year if it keeps output steady, while the prospect of an imminent flood of Iranian crude is fading as talks drag on. But virus flare-ups are causing concern. U.K. cases have spiked and Australia is racing to contain outbreaks. Other nations are renewing travel restrictions.

“A rise in production in August, and beyond, would be needed to balance the extra rise in demand,” said Hans van Cleef, senior energy economist at ABN Amro. “But uncertainties will keep OPEC and OPEC+ with their fingers on the production buttons.”

| Prices |

|---|

|

The drop in stockpiles reported by the API would be the largest since January if confirmed by Energy Information Administration data due later Wednesday. The median estimate in a Bloomberg survey is for a decline of 3.85 million barrels. The API said that gasoline inventories rose by 2.42 million barrels.

OPEC+ had been due to convene its advisory body — the Joint Ministerial Monitoring Committee — on Wednesday, but that session will now take place on Thursday. Delegates said it was to allow more time for talks, though an official letter attributed the delay to “presidential commitments” for Russian Deputy Prime Minister Alexander Novak.

The alliance is expected to increase output in August by about 550,000 barrels a day, according to a Bloomberg survey. Goldman Sachs Group Inc. forecast a similar boost, but said that even a surprise hike of 1 million barrels a day wouldn’t be enough to kill crude’s rally.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein