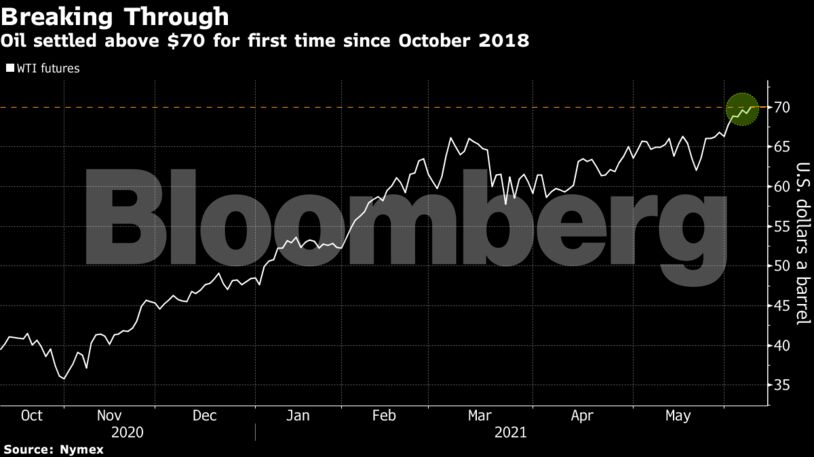

Futures in New York rose 0.5% after settling above $70 a barrel on Tuesday for the first time since October 2018. There’s no conclusive agreement to lift U.S. restrictions on Iranian oil despite the two nations making “great progress” on broader economic issues, a top Iranian official said on Wednesday. A fresh round of talks is expected later this week.

The oil market has been underpinned by a demand recovery in the U.S., China and Europe, and there are signs the Covid-19 resurgence in Asia may be easing. U.S. crude inventories have been sliding, and likely fell further last week, according to the American Petroleum Institute. Meanwhile Libya has cut crude output by almost 20% due to field maintenance and pipeline leaks.

There has also been strength in the physical market for Middle Eastern oil as Iran’s crude shows little sign of returning soon. But caution persists elsewhere. A delay in distributing quotas that allow Chinese private refiners to buy crude is adding uncertainty in Asia. A unit of China National Petroleum Corp. has even stopped supplying oil to independent processors amid a government crackdown.

The Organization of Petroleum Exporting Countries and its allies also haven’t given a clear indication of their output policy beyond July. The group has been restoring some shuttered production to the market as demand picks up in many parts of the world.

There’s a “risk of oil prices overshooting due to OPEC+ being too conservative in its output policy,” said Helge Andre Martinsen, senior oil market analyst at DNB Bank ASA. Better traffic data “and a change in perception of the likelihood of Iranian barrels returning quickly as nuclear talks drag on” are helping to push up prices, he said.

| Prices |

|---|

|

Options traders continue to bet on higher prices, with some in the market gearing up for $100 crude. There’s been a steady stream of such activity over the past month, as traders try to make money from the potential for acute market tightness.

“The price of oil is going to head higher for the right reasons,” Byron Wien, vice chairman at Blackstone Private Wealth Solutions, said in a Bloomberg Television interview. “The economy is recovering, business is doing extremely well, people are returning back to normal, they’re going to be traveling over the summer, the demand for gasoline is going to increase.”

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS