Yet across the Pacific, a rapidly growing competitor had also set its sights on dominating solar manufacturing. China, eager to prove the supremacy of its socialist-market model, was mustering government investments that dwarfed the U.S. effort and coupling them with national mandates that forced utilities to use renewable power.

It established an end-to-end supply chain — the country now makes most of the world’s polysilicon, a key material in solar panels — and ignored pleas by environmentalists to close coal plants that supply the cheap electricity needed to make solar equipment. It also kept its labor costs lower than those in most industrial countries and has been willing to prop up unprofitable operations.

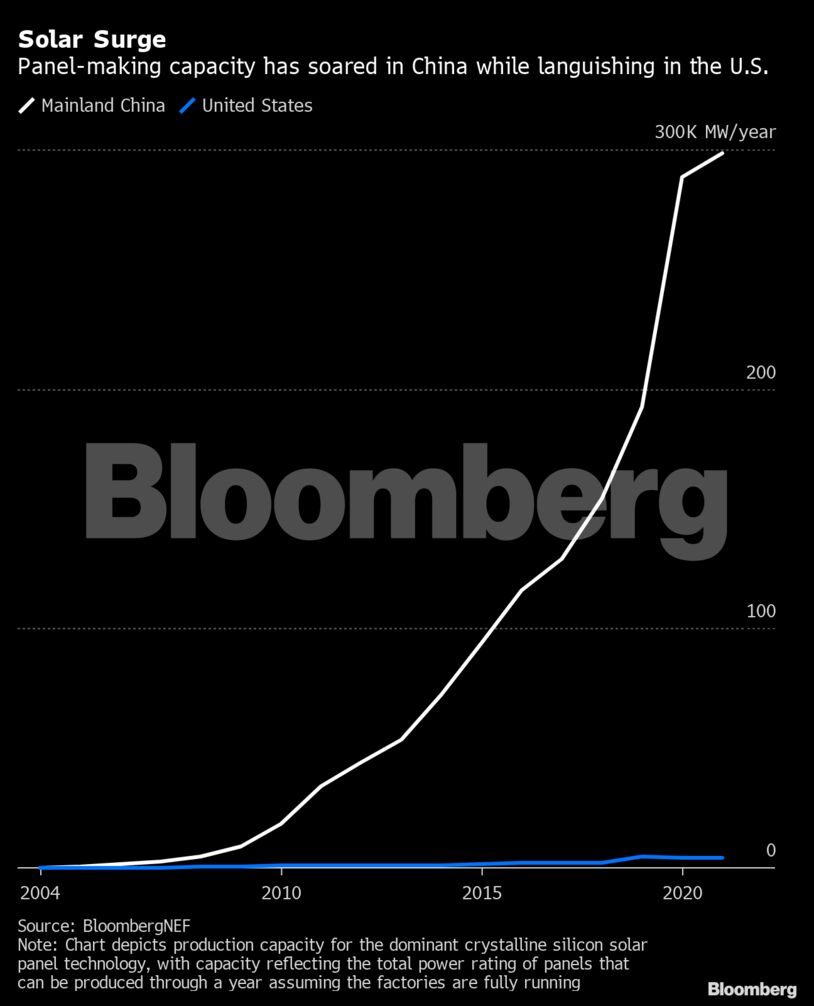

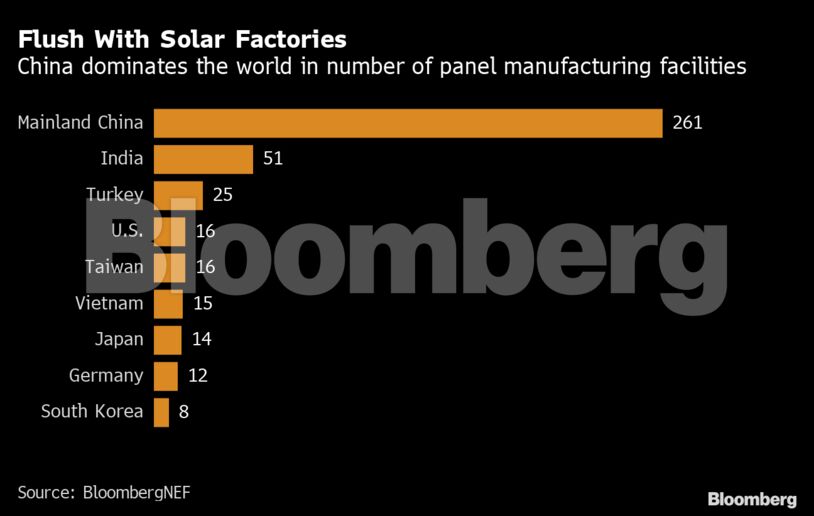

The result? Chinese firms now supply three quarters of the world’s solar panels.

U.S. companies, which 20 years ago made 22% of them, now produce just 1% on American soil, according to Jenny Chase, head of solar analysis at BloombergNEF. At one point there were 75 major solar parts factories in the U.S., a number that was expected to grow as the industry flourished. Most have since been shuttered.

The Hillsboro plant has just joined them, closing its doors after just 13 years.

The industry failed to take root in the U.S. despite billions of dollars in government incentives and nearly two decades of pledges from presidents, starting with George W. Bush, that the nation would be a clean-energy superpower. Even the crushing tariffs imposed by former presidents Barack Obama and Donald Trump succeeded mostly in pushing the work out of China and into other Asian countries.

Critics, such as Oregon Senator Ron Wyden, allege that China benefited from unfair trading practices and the use of forced labor in its supply chain — charges the nation rejects and that analysts say is unlikely to have played a significant role in the success of its solar strategy. Rather, China’s dominance is a result of Beijing’s commitment to corner the market.

“They tried harder than us,” said Sarah Ladislaw, a senior adviser at the Center for Strategic and International Studies. “China had a plan and they executed to the plan. They had policies to create supply, they had policies to create demand, and they executed on it.”

U.S. Inconsistency

At the same time, the U.S. dabbled with short-lived incentives and punishing trade barriers that spurred retaliation instead of a manufacturing renaissance. The inconsistent, piecemeal policy of the U.S. was no match for a China-styled “industrial strategy” to dominate solar manufacturing, Ladislaw said. “You can’t take the sum of a bunch of half-hearted measures and hope that it equals a durable outcome.”

For President Joe Biden, who’s made investment in renewable energy a centerpiece of his climate-change initiatives and multitrillion-dollar infrastructure plan, the failed strategies of his predecessors serve as a stark warning: Fulfilling his promise to make climate policy a jobs engine won’t be easy.

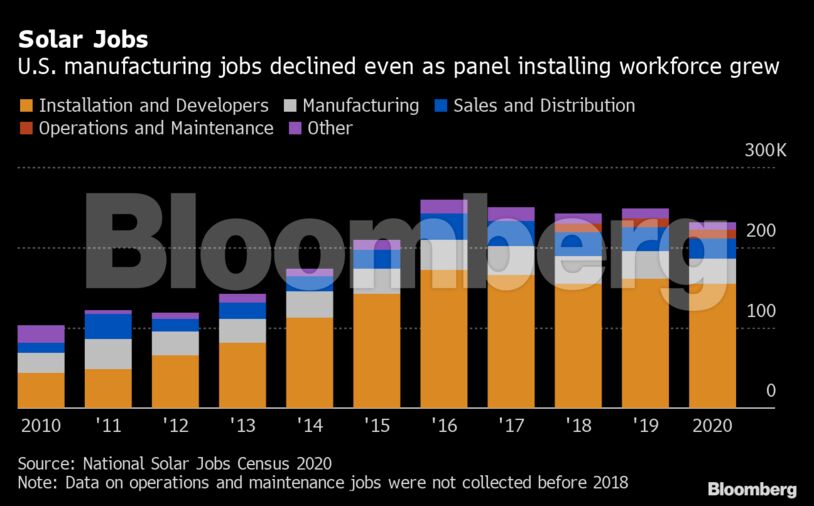

And while solar manufacturing never generated a hoped-for bonanza of jobs in the U.S., where employment peaked at about 30,000, the next clean energy contest with China will be more painful to lose. Both nations believe the future will be driven by electric vehicles, and Biden has vowed the U.S. will win the race to build them.

Yet while Detroit is planning an EV makeover, Congress is still bickering over tax credits and whether to pay for charging stations. China, meanwhile, has installed some 800,000 public chargers — about eight times the number in the U.S. — and has parlayed a combination of tax incentives, land grants, low-interest loans and other subsidies into becoming the world’s biggest producers of the vehicles for six years running.

Hundreds of companies are building electric vehicles in dozens of specialty manufacturing hubs set up around the country to take advantage of inexpensive semiconductors and batteries — two other industries Beijing has set out to dominate.

The comprehensive strategy, part of China President Xi Jinping’s blueprint to become a manufacturing superpower, echoes the one used to conquer global solar panel manufacturing. China’s victory on solar panels was so thorough that even erstwhile supporters of the U.S. renewable strategy say it’s time to give up the fight and make do with the installation jobs created by the low-cost Chinese equipment.

It’s a bitter pill for Hillsboro and its 106,000 residents. In the early days, Hughes, the former mayor, saw the solar factory as a chance to diversify an area that was so dominated by computer chip manufacturing it had been dubbed the “Silicon Forest.” Job losses at a local Intel Corp. campus underscored the risks of the city’s reliance on the volatile high-tech sector.

SolarWorld, in turn, was wooed by the promise of trained silicon workers and a state tax credit that offset 35% of project costs. Local colleges launched programs to train workers in solar manufacturing. Flush with the potential, Hughes began recruiting other manufacturers, even traveling to trade shows in Germany and Spain to pitch solar suppliers on the promise of the Pacific Northwest.

At least a dozen companies drifted through town, “some of whom looked pretty seriously at sites,” Hughes said. But “right about the time they would have been following through on funding, the whole thing fell apart.”

SolarWorld’s U.S.-made panels just couldn’t compete with better and cheaper subsidized options from China. Even the Oregon Convention Center just 18 miles (28.968 kilometers) away opted for Chinese imports.

SolarWorld filed for bankruptcy protection in 2017 and a year later sold the Hillsboro factory to competitor SunPower Corp., which is now shutting the plant.

It wasn’t supposed to be this way.

Obama won election to the White House in 2008 on a promise to create 5 million green jobs — and a surge of solar projects in the sun-drenched Southwest promised to deliver many of them. When businesses and homes go solar, every panel is “pounded into place by a worker whose job can’t be outsourced,” Obama boasted.

The work was spurred along by a 2005 tax credit that allowed developers to deduct 30% of solar project costs. Although that tax break didn’t require the use of American parts, the Obama administration tried to cultivate a domestic panel-making industry by paring tax bills for clean energy manufacturers, too.

The 2009 stimulus package created a separate 30% tax credit to steer $2.3 billion toward more than 180 advanced energy manufacturers, though only eight recipients made solar panels and the incentive program ran out of money after just one year. The Obama administration also funneled seed money to solar companies through a loan guarantee program created under Bush to nurture advanced energy technologies.

The spending looked like it would bear fruit in 2010 when Obama stopped by a solar startup’s new factory in Fremont, California, to extol the industry’s potential.

“Before the Recovery Act, we could build just 5% of the world’s solar panels,” Obama said at that Solyndra LLC. facility. “In the next few years, we’re going to double our share to more than 10%.”

But Solyndra defaulted on its $535 million loan guarantee after almost all of it had been paid out, causing a scandal and casting an enduring pall over the program. The government largely stopped offering loan guarantees through the program by late 2011. And the U.S. didn’t hit Obama’s 10% benchmark.

China was using every tool at its disposal to develop its own solar industry. Local governments offered cheap land and state-backed banks provided friendly financing terms. Beijing also created demand for the products with generous subsidies that helped make the country the world’s largest purchaser of panels.

Chinese factories also worked to improve efficiency and reduce costs. For example, they used new tools to slice thinner polysilicon wafers with less waste, producing more solar cells from the same amount of raw material. That innovation has helped lower costs by 80%, making solar as cheap as coal now in many parts of the world.

The surge of cheap panels from China dealt a crushing blow to U.S. manufacturers — and Solyndra wasn’t the only casualty. After three other U.S. solar manufacturers sought bankruptcy protection, Obama in 2012 slapped duties as high as 249% on the imports. Manufacturers responded by moving operations out of China, but they didn’t head to the U.S. Instead, large manufacturers skirted the U.S. tariffs by building facilities to assemble solar cells and modules across Southeast Asia.

Retaliatory Duties

Making matters worse, China retaliated by imposing its own duties of up to 57% on imports of U.S.-made polysilicon — tariffs that crippled U.S. producers of the conductive material used in solar panels.

“It was a disaster for the U.S. brands,” said BloombergNEF solar analyst Xiaoting Wang.

Before the Chinese tariffs, U.S.-made polysilicon had been shipped to the country and used to produce ingots, the next stage of solar cell manufacturing. But the tariffs made American polysilicon too expensive, Wang said, and the U.S. went from making 50% of the world’s polysilicon in 2007 to less than 5% today.

Half the world’s supply of polysilicon now comes from China’s Xinjiang region, where an estimated 1 million ethnic minorities, including Muslim Uyghurs, have been detained in counter-terrorism internment facilities in recent years, according to a panel of United Nations experts. The U.S., U.K., European Union and Canada have imposed sanctions against Chinese officials over alleged human rights abuses of Uyghurs, including accusations that forced labor is being used in Chinese factories. The Biden administration is weighing a ban on the import of some solar products containing polysilicon from the region too.

Beijing denies the human rights charges and has accused foreign governments of using forced labor claims as a way to help their own companies compete against China’s. When the EU issued sanctions earlier this year, China’s foreign ministry said they were “based on nothing but lies and disinformation.”

Even the deployment of solar power in the U.S. — which was aided by cheap imported parts — suffered from uncertainty, as the investment tax credit was haltingly extended at least four times and came close to expiring twice.

“It’s been a stop-start policy — one or two incentives, you build capacity, and then that was it,” said John Smirnow, vice president of market strategy at the Solar Energy Industries Association. “In a very competitive global environment, for U.S. manufacturers to succeed, especially new companies, you need the same broad-based federal investment that other governments are providing their industries.”

Domestic solar panel manufacturing was already dwindling when Trump took office in 2017 with vows to crack down on China and put “America first.” Even though he was no champion of renewable energy, Trump extended his protectionist policies to the solar industry, too, imposing import limits and tariffs as high as 30% on foreign solar cells and photovoltaic panels in 2018.

Trump’s tariffs had the potential to help a handful of panel makers stay afloat, but at the expense of wide swaths of the domestic solar power industry. While manufacturers SolarWorld, Suniva Inc. and First Solar Inc. cheered on the tariffs, they were fiercely opposed by renewable power developers and installers who feared climbing panel prices would put them out of business.

The tariffs briefly boosted some U.S. manufacturers, as both SunPower and First Solar increased production. But America’s hunger for solar power meant that imports from Asia climbed anyway, as domestic developers exploited a loophole to buy foreign-made double-sided panels not subject to the duties. And Trump’s tariffs weren’t enough to save two of their biggest champions, the now-bankrupt Suniva and SolarWorld.

Though there are now some 231,474 solar jobs in the U.S., only 14% of them are involved in manufacturing, with most of those workers building mounting systems, inverters and other components instead of the photovoltaic panels.

The U.S. is far from alone. Other early solar adopters, including Germany, have seen their panel making plummet. “Germany’s once-thriving PV wafer, cell, and module manufacturers are now largely gone,” Ladislaw and other authors said in a February paper. “All have been out-competed and driven into bankruptcy by the rapid cost reductions achieved by foreign firms.”

Undaunted, Biden is promising his climate policies will cultivate U.S. jobs, but it’s not clear they’ll come in the field of solar-panel manufacturing.

Even some beneficiaries of Trump’s tariffs aren’t pushing Biden to renew the levies when they expire next February. First Solar, for instance, has advocated a broader industrial strategy to spur domestic panel making.

Biden is trying to encourage renewable manufacturing with his multitrillion-dollar infrastructure package and a plan to revive the lapsed 2005 tax credit worth nearly a third of the cost of factories making solar panels. Buy-America mandates could also be imposed for federally funded solar projects, an idea advanced by several Republican senators.

But a few new U.S. panel plants would do little to loosen China’s stranglehold on the rest of the solar supply chain, which extends beyond panels to the polysilicon that is used to make them. China now produces more than 80% of the polysilicon and roughly 98% of two other key components — wafers and ingots — that are used in panels worldwide, even those manufactured and assembled in other countries.

Even as he touts climate action as a job creator, Biden seems focused on the potential of other fields.

“There’s no reason the blades for wind turbines can’t be built in Pittsburgh instead of Beijing, no reason why American workers can’t lead the world in the production of electric vehicles and batteries,” Biden told a joint session of Congress earlier this year.

The U.S. still has a shot at innovating the next generation of solar technology, said Julio Friedmann, a senior research scholar at Columbia University’s Center on Global Energy Policy.

“We’re starting to plateau on existing solar technologies, and we need the next generation,” Friedmann said. “That is another opportunity for America to excel, because we have a great innovation system. We have an opportunity to leapfrog to the next generation.”

To avoid the mistakes of the past, solar supporters say future efforts must be big and long-lasting.

“There is a real opportunity to make lasting change to strengthen the industry here at home and create new jobs,” said Wyden, the Democratic senator from Oregon who was at the Hillsboro plant’s opening. “It will take coordinated effort across the government — on everything from R&D, tougher enforcement of trade laws and reforms to the tax code — to better incentivize domestic manufacturing, to level the playing field and get the U.S. back in the solar manufacturing game.”

Still, it’s too late for solar workers in Hillsboro, a former farming community whose fortunes were once tied to the price of strawberries and by 2008 had become tethered to the volatile chipmaking industry instead.

The region’s economy has managed to diversify despite the loss of the solar plant, though Intel remains one of Oregon’s biggest corporate employers and continues to give the city an occasional scare. Last year, for example, Intel spooked local residents when it reportedly mulled outsourcing some advanced manufacturing to Asia.

“The thing about being a company town is that when Intel sneezes, everybody gets a cold,” said Hughes, 77.

The now-retired mayor doesn’t regret the city’s experience with the solar factory and would even open the city gates to another manufacturing upstart.

But he might not try to build an entire strategy around the solar industry. “I suspect I probably wouldn’t do that again,” he confessed, “although it was fun going to all the solar trade shows.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet