By Michael Bellusci

“To date, we have not seen any material flow of funds from generalist investors” or institutional money, says managing partner Adam Rozencwajg. “The move will be violent when it happens.”

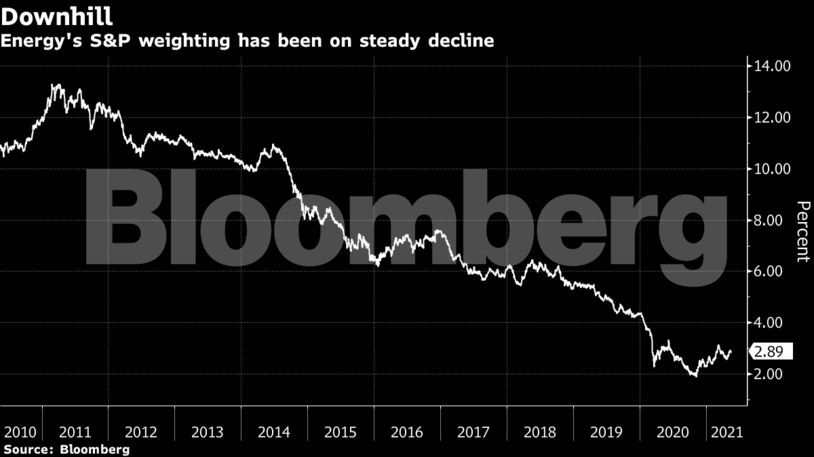

Shrinking Presence

Part of this may come down to simple index weightings, where energy has become just a tiny slice of the stock market. The group accounts for less than 3% of the S&P 500 after being in the double digits 10 years ago.

Energy bulls got a little encouragement in February when Warren Buffett’s Berkshire Hathaway Inc. disclosed a stake in Chevron Corp., according to Bank of Montreal capital markets. Berkshire’s ownership stole headlines, though BMO’s scan of 13F filings also showed broad-based increases in active long-only ownership across E&P stocks after steady declines in recent years, analyst Phillip Jungwirth told clients in a February note.

Shale drillers also offer hope about the macro environment, as they’re generating cash and giving back to investors without increasing supply. EOG Resources Inc. reiterated a no-growth outlook for this year at Citi’s global energy conference earlier this week, according to the bank. The company also declared a surprise special dividend after generating record cash in the first quarter.

Earnings Encouragement

Meanwhile, first-quarter earnings from 40 U.S. shale drillers were generally positive, according to KeyBanc Capital Markets. Almost 80% of the group beat cash flow per share/Ebitda estimates, analyst Leo Mariani wrote in a note to clients.

The cyberattack on Colonial Pipeline Co.’s fuel distribution line along the U.S. Eastern Seaboard didn’t do much damage to refining stocks, as a prolonged shutdown was avoided. The approaching summer driving season and the lifting Covid-19 restrictions are keeping analysts bullish.

“What we’re calling the ‘summer of YOLO’ should drive a large-scale recovery in gasoline/jet demand this summer as the U.S. (and hopefully the world) returns to normal,” according to Raymond James. “This narrative will be very hard to fight,” analyst Justin Jenkins wrote in a note to clients.

One cause for concern is inflation. While oil’s generally thought to benefit from rising prices, in this case it raises the specter of a less accommodative U.S. Federal Reserve, which could hurt crude. That, however, isn’t bothering Leigh Goehring. “Inflation is a massive, massive positive tailwind” for oil & gas companies, which are “asset-heavy,” he said.

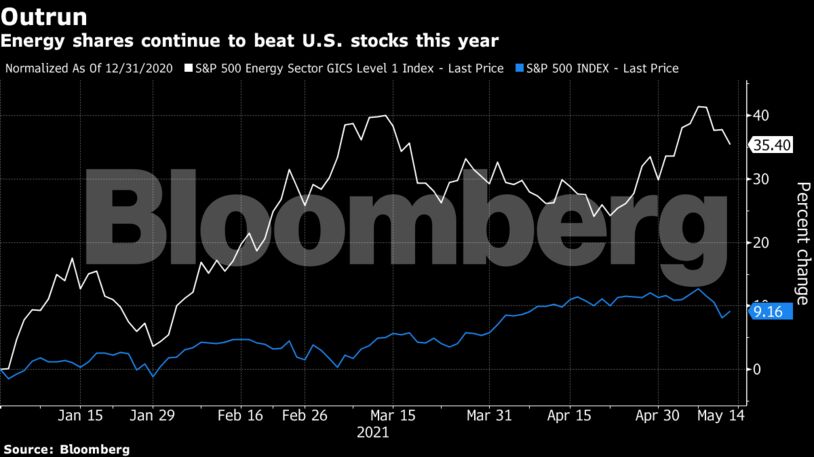

While rising oil prices have fueled the early stages of an earnings recovery for energy firms, the longer-term outlook is murkier, BMO’s chief investment strategist Brian Belski said earlier this week as he upgraded the sector to market weight from underweight.

“Secular supply and demand dynamics for oil will likely make it difficult for the energy sector to sustain any type of outperformance over the longer-term,” he concluded.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS