This is just the latest indicator of the extreme tightness for U.S. crude supplies as shale producers stay cautious on production after last year’s oil crash. Meanwhile, demand for commodities is surging across the board amid a rebound for the world’s largest economies. That’s stoking inflation concerns and underscores why some traders are betting on staying power for this year’s supercharged rally for energy, metals and agriculture.

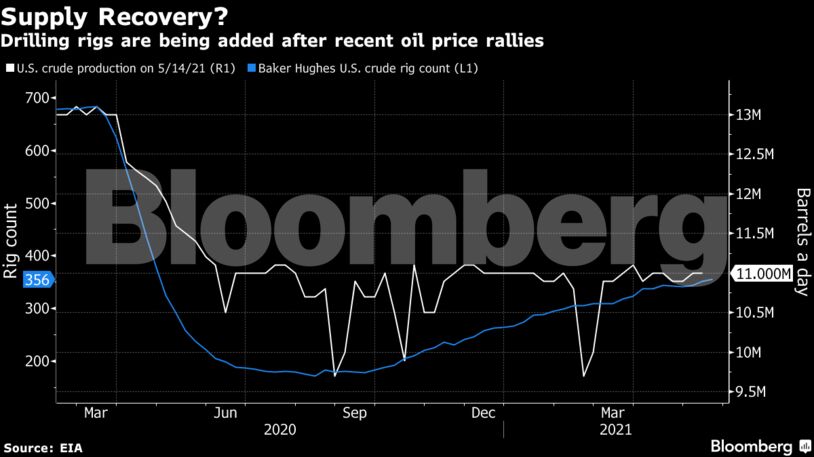

U.S. oil output is hovering at 2 million barrels a day, below last year’s peak last year even as benchmark WTI oil futures have surged more than 35% this year and are trading at pre-pandemic levels. Drillers are sticking with the austerity promises they’ve made to investors. In fact, explorers are adding just enough rigs to offset natural declines at wells already in production.

Meanwhile at the Cushing hub, inventories are below the five-year average. At the same time, American refiners gearing up to meet an anticipated boom in summer demand after the country’s vaccination campaign prompted a steady re-opening of states.

The June-July WTI time-spread surged 67% in two days from 12 cents a barrel on Friday. The spread trades in the three-day period after the expiration of the front-month futures contract. It also enables market participants to roll long positions into the next month.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein