By Julian Lee

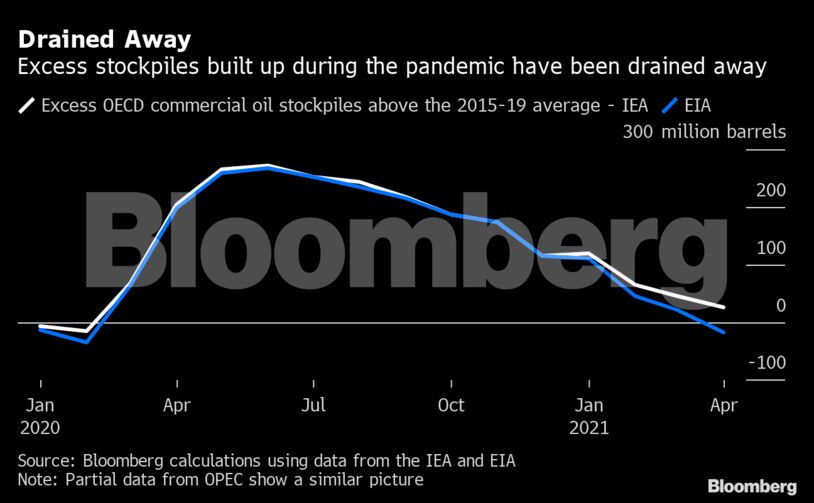

The International Energy Agency, the U.S. Energy Information Administration and the Organization of Petroleum Exporting Countries all agree that the oil stockpiles built up in the developed nations of the OECD have all but disappeared, as producers have maintained discipline, while demand has picked up from the depths of 2020.

Excess commercial stockpiles in the OECD countries, which ballooned to as much as 270 million barrels above their 2015-19 average in June, are now almost back to that benchmark level. That was the target set in January by Saudi Energy Minister Prince Abdulaziz Bin Salman to measure the success of the oil producers’ attempts to rebalance oil markets after the pandemic triggered an unprecedented slump in global oil demand last year.

That doesn’t mean producers are going to suddenly reopen the spigots and flood the world with oil. Demand in the second quarter is still about 4 million barrels a day below the same period in 2019, according to both the IEA and OPEC (the EIA sees the deficit about 3.4 million barrels). And a closer look at the latest outlooks shows reasons to remain cautious.

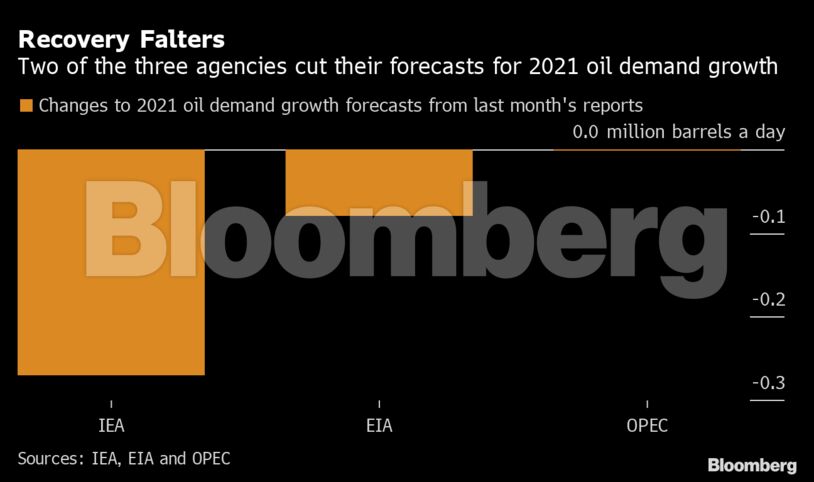

Two of the three (the IEA and EIA) have cut their forecasts of oil demand growth this year, with only OPEC leaving its outlook unchanged. The biggest reduction came from the Paris-based IEA, which reduced both demand and year-on-year growth by 270,000 barrels a day, more than wiping out the upward revisions it made to those same figures last month. It now sees oil demand increasing by 5.42 million barrels a day on average this year, compared with 5.69 million barrels a month ago.

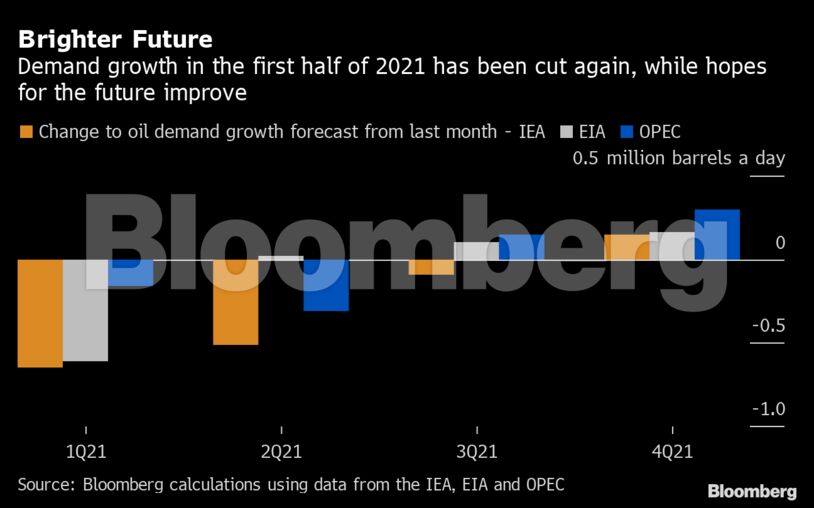

But that headline figure hides a feature that raises greater concerns — how the demand growth is spread across the year and it’s a feature that is common to all three forecasts. All of the agencies have cut their estimates of demand growth in the first quarter, as data have become available from more countries, indicating that the recovery at the start of the year wasn’t as robust as had previously been thought. For the IEA and EIA, the reductions were more than 0.5 million barrels a day.

The IEA and OPEC have also cut their oil demand and year-on-year growth forecasts for the current quarter — in the IEA’s case, again by more than half a million barrels a day.

They have partly compensated for these reductions by boosting their growth forecasts for the second half of the year.

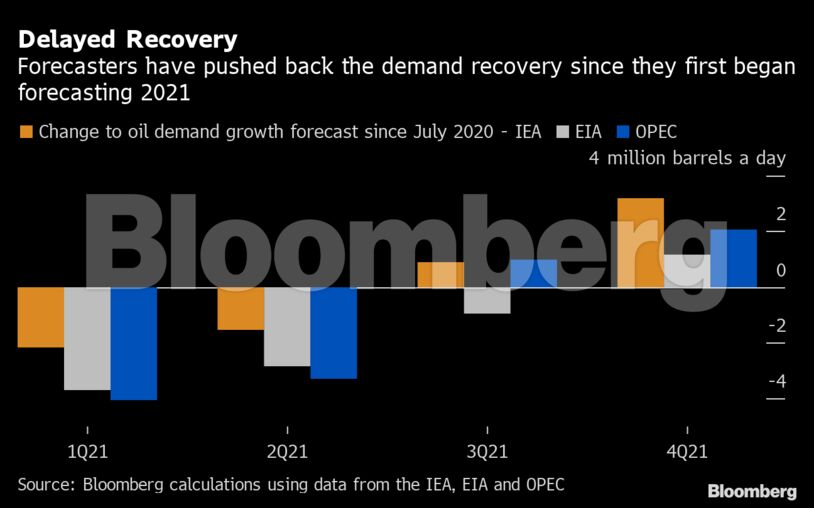

This trend isn’t new. Comparing the latest demand growth forecasts with those made in July 2020 — the first month that all three agencies published detailed quarterly forecasts for 2021 — we can see how the recovery has been pushed back. Forecasts of year-on-year demand growth in the first half of 2021 have been slashed by as much as 4 million barrels a day, while those for the second half, particularly the final quarter, have been raised.

The growing dependence on the second half of the year to drive the upturn is a worry because, as the IEA notes, “the recovery in global oil demand remains fragile as surging Covid cases in countries such as India and Thailand offset recent more positive trends in Europe and the U.S.”

As long as those outbreaks can be contained and controlled, the recovery looks set to continue, but if they spread more widely, as earlier ones did, then the recovery elsewhere could be at risk too.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS