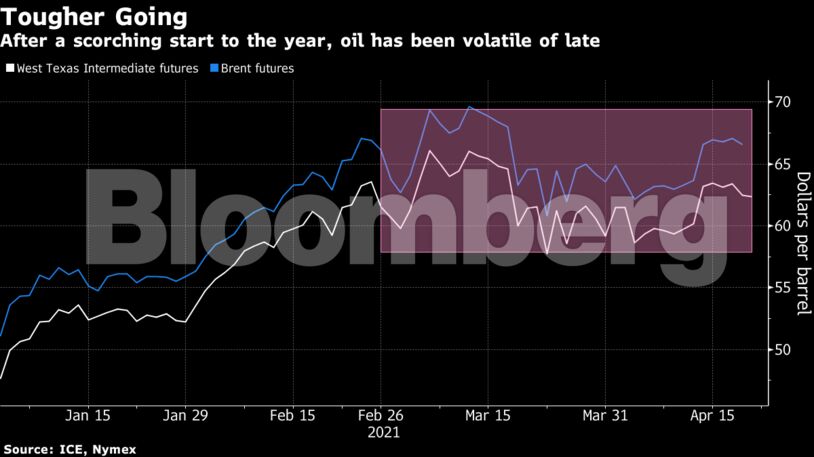

Oil’s value has risen by more than a quarter this year as vaccines are rolled out, paving the way for a relaxation of lockdowns, greater economic activity and increased mobility. Against that backdrop, the Organization of Petroleum Exporting Countries and its allies are likely to focus on reviewing the market rather than revising plans to boost supply, according to key member Russia.

Still, the flare-up in India’s cases is undermining the narrative that there’ll be an uninterrupted rebound in global consumption.

“A stronger dollar and concern that rising Covid-19 cases will slow down the oil demand recovery” are underpinning price moves on Wednesday, said Giovanni Staunovo, a commodity analyst at UBS Group AG.

| Prices |

|---|

|

The American Petroleum Institute reported a 436,000-barrel weekly gain in crude stockpiles, while gasoline supplies fell by more than 1.6 million barrels, according to people familiar with the data. If confirmed by government figures later Wednesday, it would be the first build in crude inventories in four weeks.

In India, soaring virus cases have forced the financial and political capitals to impose curbs on movement. Prime Minister Narendra Modi has asked states to avoid shutting businesses, but “the health burden may soon catch up and force Indian authorities to respond more harshly,” said Louise Dickson, an oil markets analyst at Rystad Energy AS.

In Japan, Tokyo and Osaka — the two biggest cities — are asking the government to declare a state of emergency to contain a surge in cases just three months before the start of the delayed Olympic Games.

Still, there are positive signs in China. Among data points, congestion during morning rush hours in cities including Beijing was higher than 2019 levels in the week to April 12, according to TomTom International BV. In the U.K., road use reached 99% of pre-pandemic levels on April 18, government data show.

| Related news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire