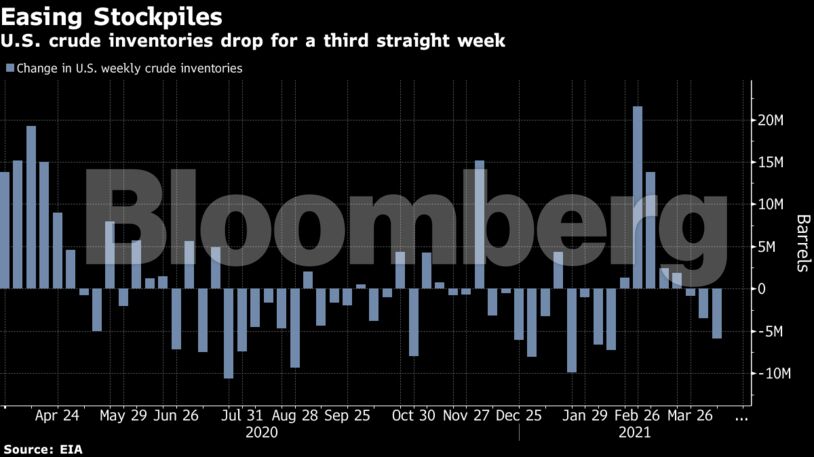

Apr 15, 2021 Futures in New York traded near $63 a barrel on the back of the longest run of gains in more than a month. Signs of a stronger U.S. market are abounding. The number of miles driven on U.S. interstates rose versus the same period in 2019 for the first time since the pandemic began. U.S. crude inventories dropped the most in almost two months last week, while a gauge of gasoline demand ticked higher for a seventh straight week. Oil had been stuck near $60 a barrel after a rally faltered in mid-March amid a resurgence in virus cases in some regions. While the IEA sees a temporary lull in the market due to the renewed outbreaks, it followed OPEC in boosting its demand estimates for this year as the economy rebounds from the pandemic.

“The environment on the oil market remains favorable,” said Eugen Weinberg, head of commodities research at Commerzbank AG. “The picture in the oil market is continuing to brighten despite ongoing restrictions in Europe and India.”

There are reasons to be cautious, however. The pandemic is raging in India, while OPEC and its allies are about to start adding more supplies. Another wildcard is Iran, which is seeking to revive a 2015 nuclear deal and have U.S. sanctions removed to lift crude exports, but progress on that remains uncertain. The demand picture in Europe is also wobbly, with toll road traffic on France the weakest since May last week.

(Bloomberg)

Prices

Other oil-market news:

Share This:

Oil Drops Below $63 After Jumping on Stellar U.S. Demand Data

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire