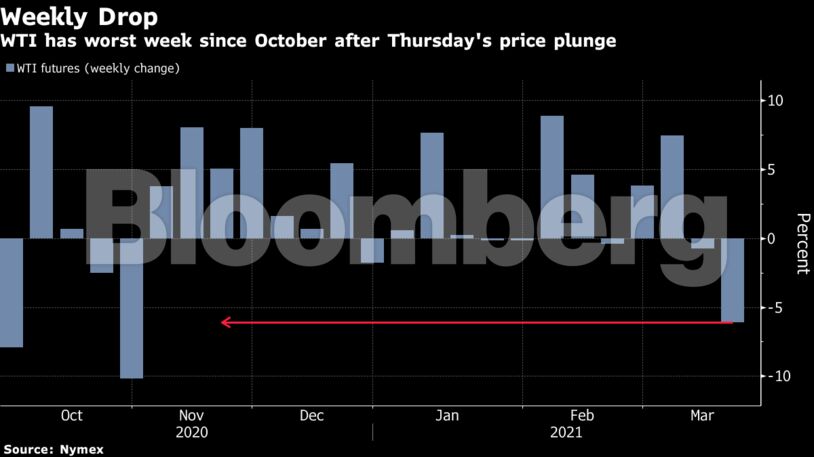

Futures in New York ended the week 6.4% lower, with Friday’s rise doing little to reverse the previous session’s swift price plunge. A combination of factors conspired to bring a 30%-plus rally this year to a screeching halt: Treasury yields that pushed the dollar higher, signs of weaker consumption in Asia in the short-term and the unwinding of long positions by commodity trading advisors. Technical indicators had shown a market correction was overdue.

Still, investment banks from Goldman Sachs to Morgan Stanley said demand is set to recover and supplies will tighten, with the rout offering a buying opportunity for a market that may have gotten too long for its own good.

“What happened yesterday is not indicative of overly soft physical markets,” said Michael Tran, an analyst at RBC Capital Markets. “The market was getting pretty stretched, so given the general headlines of China slowing to some degree, Covid returning in Europe and demand maybe not being as robust as people had thought, these are all just convenient opportunities for the market to rebase, retrench and reload heading into the summer.”

In the days leading up to Thursday’s price rout, money managers cut their bullish positioning in oil, with hedge fund’s combined wagers on rising Brent and West Texas Intermediate prices slumping to a five-week low in the week ending March 16, according to weekly ICE Futures Europe and CFTC data. But even after the abrupt setback, futures are still up more than 20% so far in 2021 on prospects for a recovery this year from the coronavirus pandemic and OPEC+’s output discipline thus far.

The sell-off will prove to be “transient” and this week’s decline presents a buying opportunity, Goldman analyst Damien Courvalin said in a note. There will still be a swift rebalancing of the market, with vaccinations driving an increase in mobility, he said.

See also: OPEC Sees Cautious Oil Strategy Vindicated as Prices Plunge

Undersupply is likely to continue through this year should demand accelerate and OPEC+ continue to show output restraint, Morgan Stanley said in a report. In that case, the market should remain in deficit, allowing inventories for countries in the Organization of Economic Cooperation and Development to normalize during the third quarter, analysts Martijn Rats and Amy Sergeant wrote.

Meanwhile, Saudi Arabia said a drone attack at an Aramco refinery in Riyadh had no impact on oil supplies, according to the country’s state-run Saudi Press Agency, which said Yemen’s Iran-backed Houthi rebels were behind the attack.

| Prices: |

|---|

|

The S&P 500 Energy Index was little changed Friday after slumping 4.7% on Thursday for its biggest decline in more than three months.

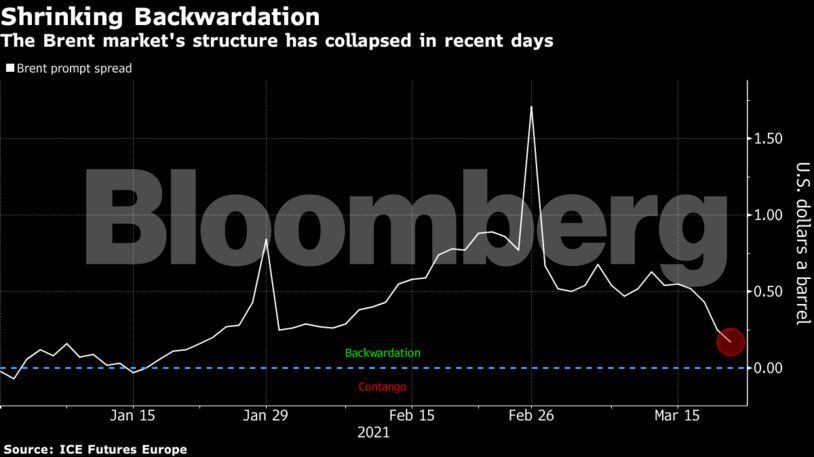

For now, there are signs of weakness in physical market demand, particularly in Asia. At the same time, Europe’s vaccine rollout remains sluggish — another headwind for the recovery in consumption. The oil market’s structure also weakened markedly. Key gauges of supply for West Texas Intermediate and Brent crude veered nearer to a bearish contango structure, signaling oversupply.

Still, data from the U.S. suggest that the latest bout of fiscal stimulus may help to spur travel there, while a dozen states are expanding access to Covid-19 vaccinations earlier than planned.

“Don’t mistake a correction for a derailment,” JPMorgan Chase & Co. analyst Natasha Kaneva wrote in a note to clients. “The price move was likely accentuated by a washout of investor length which has been steadily rising since late last year.”

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS