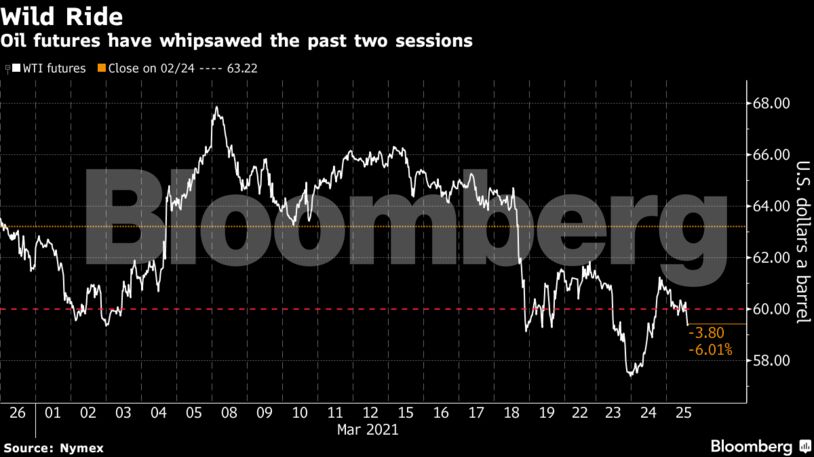

Futures in New York slid 3%, the latest sizable move this week. Work to re-float the container ship that’s stuck in the canal — a key trade route for crude flows — was expected to begin early Thursday in Egypt. The best chance of freeing the vessel may not come until Sunday or Monday.

Crude’s renewed decline on Wednesday was assisted by weakness in broader markets and a stronger dollar. U.S. crude stockpiles, meanwhile, have continued to climb, though domestic fuel consumption has expanded.

Despite the recent sell-off, oil is still up more than 20% this year and there is confidence in the longer-term outlook for demand as coronavirus vaccinations accelerate worldwide while OPEC+ output cuts tighten supply. The alliance is scheduled to meet next week to decide production policy for May in a gathering that will be keenly watched by the market.

“It all got a bit too excited earlier with talk about supercycles and massive stockdraws in the first quarter,” said Paul Horsnell, head of commodities research at Standard Chartered. That was “never on the cards, the big stock draws come later.”

| Prices |

|---|

|

The prompt timespread for Brent flipped back into a bullish backwardation on Wednesday after ending in a bearish contango in the previous session for the first time since January. It was 16 cents in backwardation on Thursday, compared with 67 cents at the start of the month.

See also: Drill, Baby, Drill Drives the U.S. Shale Patch: David Fickling

Tugs and diggers have so far failed to dislodge the container ship in the Suez Canal, which has led to a gridlock of vessels waiting to pass. The spring tide on Sunday or Monday will add extra depth and allow for more maneuvering, said Nick Sloane, the salvage master responsible for refloating the Costa Concordia.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS