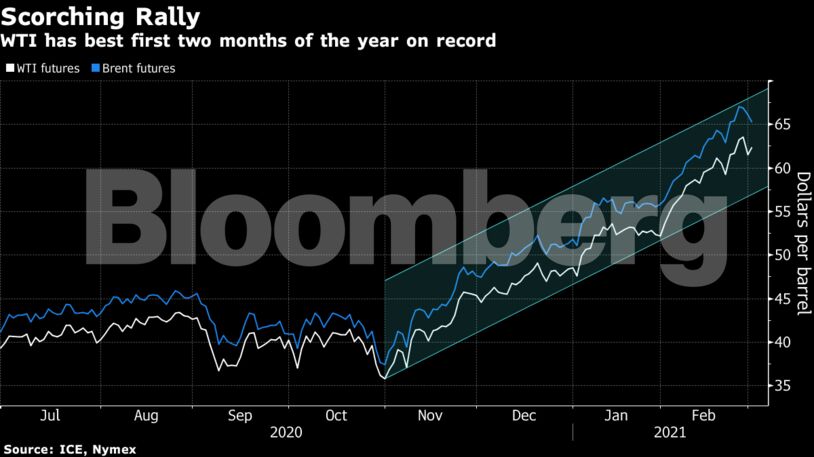

Mar 1, 2021 Futures in New York rose above $62 a barrel. The alliance gathers on Thursday and is expected to loosen the taps after prices got off to their best ever start to a year. But it’s unclear how robustly the group will act, with the Saudi Arabian energy minister calling for producers to remain “extremely cautious.”

Oil’s recovery from the impact of the pandemic has been driven by Asian demand, as well as fiscal and monetary stimulus. Data Monday showed most key manufacturing economies gained ground last month, with China staying in expansionary territory. Positive sentiment in equity markets also aided crude, while President Joe Biden’s $1.9 trillion relief plan moved closer to realization after passing the House of Representatives. Saudi Arabia’s output curbs, the improving demand outlook as vaccines are rolled out, and the growing popularity of commodities as a hedge against inflation have pushed oil higher this year. There has been a raft of bullish calls in recent weeks predicting the rally will continue as the producer response trails consumption, while maintenance in North Sea fields is set to reduce supply.

“OPEC+ is well aware of the market’s view: the remarkable achievement of the last ten months will be seriously damaged in case of complacency,” said Tamas Varga, analyst at PVM Oil Associates Ltd. “The current oil balance could live with a moderate production increase but could not justify a bigger one.”

At stake in the meeting is how much OPEC+ output gets restored and at what pace, with current reductions amounting to just over 7 million barrels a day, or 7% of global supply. The 23-nation coalition will decide whether to revive a 500,000-barrel tranche in April, and in addition, whether the Saudis confirm an extra 1 million barrels they’ve taken offline will return as scheduled.

Citigroup think the group will boost about by 500,000 barrels a day next month, with Saudi Arabia unlikely to continue its voluntary curbs.

(Bloomberg)

Prices:

Related coverage:

Share This:

Oil Powers Ahead as Critical OPEC+ Meeting Looms, Markets Rally

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet