(Bloomberg)

Oil’s gains on Friday came amid a rise in broader markets and a weaker dollar, aided by optimism around Covid-19 vaccine distribution. Still, U.S. virus cases are rising again and some European countries renewed lockdowns in a setback for the global recovery. The impact on the oil market from the blockage is likely to be muted, with crude flows from the Middle East to Europe declining due to a long-term realignment of trade. While plenty of oil is shipped from the North Sea to Asia, it’s usually carried on tankers that are too large to pass through the canal.

There are also ample oil-product supplies across the region, with inventories at the major hub of Singapore holding near the five-year average. None of that has stopped crude from undergoing wild swings so far this week, though. “The last days feel like oil investors are on a roller coaster,” said Giovanni Staunovo, commodity analyst at UBS Group AG. “Drops are followed by a rise the day after, with fundamental news not being able to explain those shifts.”

Volatility in the oil market has climbed recently to the highest since November and the prompt timespread for global Brent crude flipped briefly into a bearish contango on Tuesday. It’s now back in a bullish backwardation structure — where near-dated contracts are more expensive than later-dated ones.

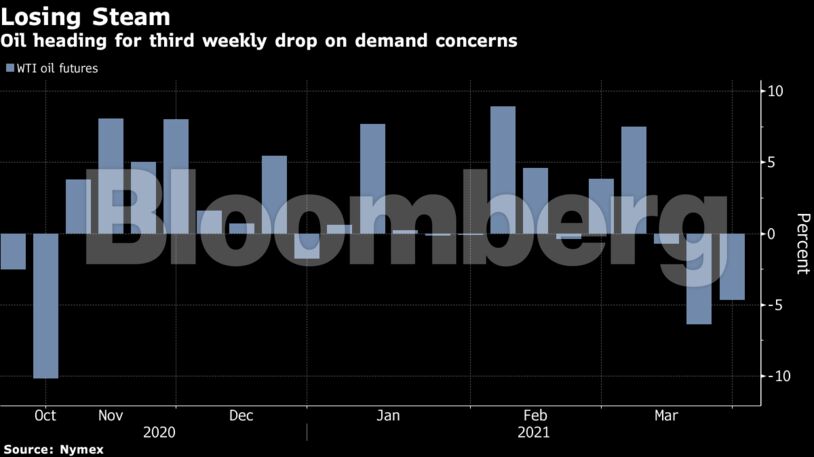

Oil has sold off in recent weeks amid softening physical demand, a stronger dollar and the unwinding of long positions. Despite the recent declines, prices are still up more than 20% this year and there is confidence in the longer term outlook as vaccination rates climb and OPEC+ keeps supply in check. The group meets next week to decide on its production policy for May.

“The turbulence of oil prices is making trading unpredictable,” said Paola Rodriguez Masiu, Vice President of Oil Markets at Rystad Energy. “Market participants are at a crossroad, trying to pick what’s more significant, bullish transport disruptions or bearish European lockdowns.”

Prices

Other oil-market news:

Share This:

Oil Gains With Broader Markets While Suez Impact Limited

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS