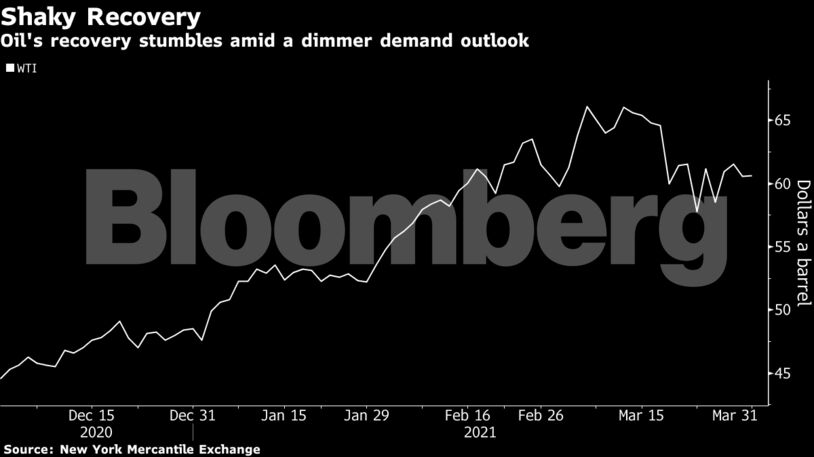

West Texas Intermediate moved between small gains and losses, after dropping 1.6% on Tuesday. In the run-up to Thursday’s closely watched ministerial talks, an OPEC+ panel revised down consumption estimates for the year. Still, the alliance also expects the surplus built up during the pandemic to be mostly gone within the next quarter.

Demand remains sluggish in many parts of the world as virus cases continue to restrict travel. In Europe, France is leaning toward a national lockdown, while Spanish refiner Repsol said it’s cutting processing at one site due to weak fuel use. The global picture is far from uniform though, with China’s manufacturing figures beating estimates, pointing to higher-than-expected industrial activity.

Oil has pulled back in recent weeks — paring a quarterly increase — amid stricter lockdowns in some European countries, while in the U.S., data from OPIS by IHS Markit show gasoline sales trailing pre-pandemic levels by 16%. OPEC+ is expected to keep output stable when it meets this week, meaning millions of barrels a day of supply remain on the sidelines.

“The oil market is currently facing something of a paradox, with Brent prices above $60 a barrel, but at the same time the world having ample spare production capacity,” said Helge Andre Martinsen, senior oil analyst at DNB Bank ASA. “We expect OPEC+ to roll over production quotas from April to May.”

| Prices: |

|---|

|

The Organization of Petroleum Exporting Countries and its allies will debate whether to revive part of the 8 million barrels of daily output — about 8% of global supply — they’re withholding. After surprising traders at the last session by not easing curbs, the group is now expected to maintain that position.

At the same time, Saudi Aramco, the state-owned oil giant, is expected to raise its Arab Light official selling price for May supplies by 30 cents a barrel, according to the median estimate in a Bloomberg survey of refiners and traders. That’s despite continued flows of Iranian crude into China, and challenging conditions for many Asian refiners.

| Related news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS