LONDON (Reuters) – Oil prices climbed above $70 a barrel for the first time since the start of the coronavirus crisis, after the U.S. Senate passed a $1.9 trillion economic stimulus package and a Yemeni group attacked Saudi Arabia’s oil industry.

Benchmark Brent climbed as high as $71.38 a barrel in early Asian trade, its highest since Jan. 8, 2020. By 1110 GMT, it was trading up 12 cents or 0.2% at $69.48, still hovering around its highest level in more than a year.

U.S. West Texas Intermediate (WTI) crude was up 14 cents or 0.2% at $66.23 after touching $67.98 a barrel, its highest since October 2018.

Brent and WTI prices have climbed for four consecutive sessions.

(Graphic: Brent crude tops $70, WTI hits 2-year highs after reports of attacks on Saudi Arabian facilities link: )

The U.S. Senate passed on Saturday President Joe Biden’s $1.9 trillion COVID-19 relief plan, lifting prospects for the economy and fuel demand that has been pummelled by the pandemic.

Adding support, Houthi forces in Yemen fired drones and missiles at Saudi Arabia, including a Saudi Aramco facility at Ras Tanura that is vital to petroleum exports. Riyadh said there were no casualties or loss of property.

“This suggests that we could see further upside in the market in the near-term, particularly as the market probably now needs to be pricing in some sort of risk premium, with these attacks picking up in frequency,” ING analysts said in a report.

Prices have been buoyant since the Organization of the Petroleum Exporting Countries, Russia and their oil producing allies, known as OPEC+, agreed last week on broadly sticking with output cuts despite rising crude prices.

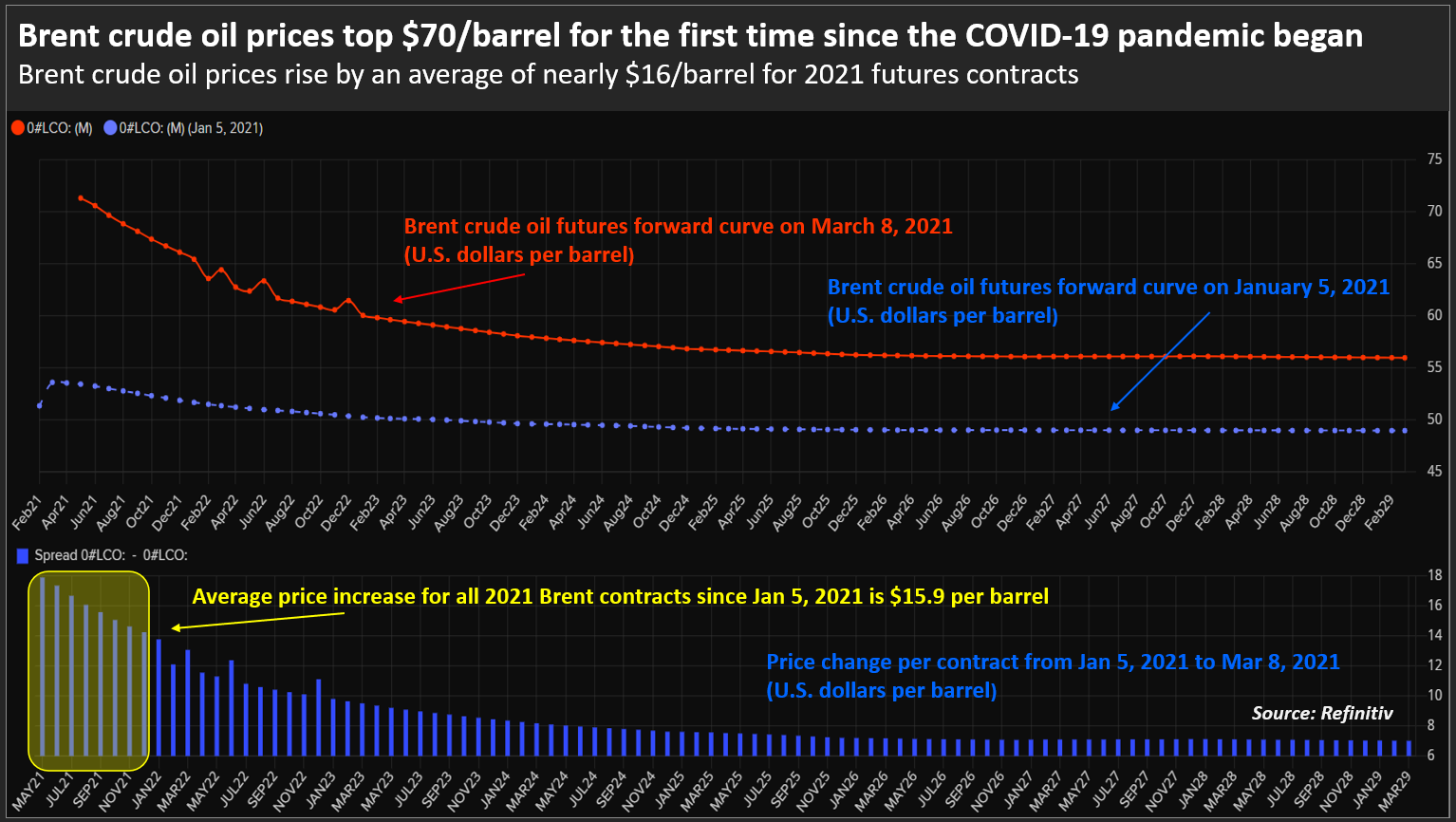

(Graphic: Brent crude oil prices top $70/barrel for the first time since the COVID-19 pandemic began link: )

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet