Goldman said its sustainability bond was well received by investors from the U.S., Europe and Canada, in addition to other countries, including new investors. The order book reached well north of $3 billion at the peak, with more than half of the deal going to ESG accounts. The demand helped it price 5 basis points inside of the bank’s normal credit curve for the tenor, Halio said.

“We do think the size of our ESG bonds will grow over time,” said Halio. “We think investors value the liquidity in the benchmark size issuance.”

Read more in the Green Bond Weekly column: ‘Greenium’ Increased, Despite Issuance Deluge

The firm will also consider issuing in different currencies in the future, including in euros. David Solomon, chairman and chief executive at Goldman, said in a Friday statement that building a low-carbon and an inclusive economy is a “business imperative” and the lender is demonstrating its commitment by using the same financial toolkit the bank recommends to its clients.

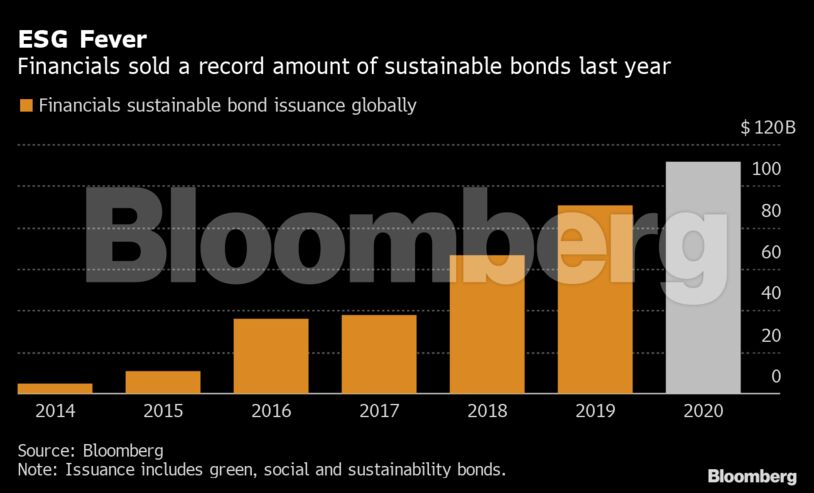

Financial firms globally have raised about $25.5 billion pf ESG-linked debt this year, making the sector the biggest issuer of sustainable bonds after governments, according to data compiled by Bloomberg. The sector borrowed a record $111.8 billion last year. That included deals from Bank of America Corp., Citigroup Inc. and Morgan Stanley.

Goldman is joining other top Wall Street banks that have been issuing ESG bonds amid pressure for the private sector to do more to promote ESG issues. JPMorgan Chase & Co., the biggest U.S. bank by assets, priced a $1 billion social bond on Tuesday and raised a similar amount of green debt last year.

“It was so critical to us to do a robust evaluation of what we’ve seen over recent years to identify a group of themes where we feel we can really advance the transition and advance the story globally,” Heather Miner, global head of investor relations for Goldman, said in the interview.

Nuveen, which oversees $1.2 trillion in assets, participated in the Goldman deal, said Stephen Liberatore, head of fixed-income ESG and impact investing strategies at the firm. They found the valuations attractive and liked the bank’s sustainability framework, which is “robust” and allows them to invest in a broad range of environmental and social projects.

Proceeds will help to fund or refinance a combination of loans and investments made in projects and assets that meet Goldman’s green and social eligibility criteria, including clean energy, sustainable transport and financial inclusion, according to the framework.

“The more issuers come and the more prominent those issuers are, only helps further the message that we are looking at things in a different way,” said Liberatore. “That’s a real positive and should help borrowers that maybe aren’t sure what they need to do.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire